Why Lightning Damage Insurance Claims Require Expert Navigation

A lightning damage insurance claim can be one of the most complex property insurance matters you’ll face as a commercial property owner. When lightning strikes, it doesn’t just cause obvious damage—it creates a cascade of hidden issues that can cost hundreds of thousands of dollars if not properly identified and documented.

Quick Answer for Lightning Damage Insurance Claims:

- Document everything immediately – Take photos and videos of all visible damage

- File your claim within policy deadlines – Most require notification within 30-60 days

- Identify all three types of damage – Direct strike, near miss, and ground surge effects

- Get professional inspections – Electrical, structural, and HVAC systems need expert evaluation

- Consider a public adjuster – They maximize settlements and prevent claim disputes

According to industry data, lightning claims average $30,000, with insurers paying out over $900 million annually. For commercial properties and multifamily complexes, the costs can be exponentially higher. The challenge is the hidden damage. Power surges from lightning travel through electrical, HVAC, and plumbing systems. Shockwaves can crack foundations, and fires can start hours later, making expert evaluation critical from day one.

Insurance companies often underestimate these claims because much of the destruction is hidden. They may focus on obvious roof damage while ignoring the broader impact on your property’s infrastructure.

I’m Scott Friedson, a Multi-State Licensed Public Adjuster who has successfully negotiated hundreds of millions in property damage settlements over 15+ years. My experience with complex lightning damage insurance claim cases shows how critical proper documentation and expert advocacy are for achieving fair settlements while avoiding costly litigation.

Quick look at lightning damage insurance claim:

Identifying the Full Scope of Lightning Damage

When lightning strikes your commercial property, you’re dealing with one of nature’s most powerful forces. A single bolt packs up to one billion volts of electricity and is hotter than the sun’s surface, causing devastating damage that extends far beyond what’s visible. The challenge with a lightning damage insurance claim is that much of the destruction happens behind walls, underground, and within building systems.

Whether you own an apartment complex in Austin or a commercial building in Dallas, the impact can be property-wide and incredibly expensive.

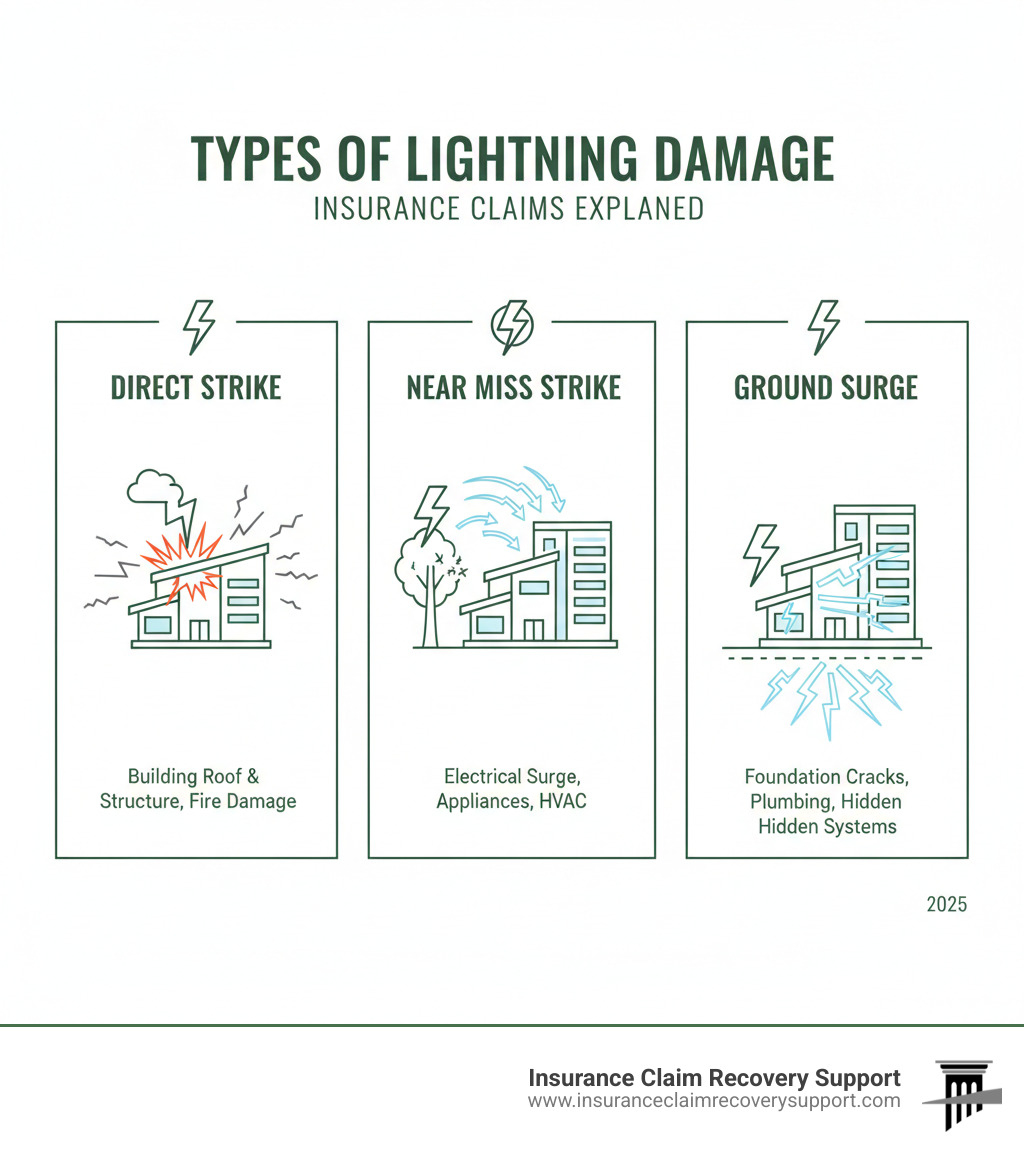

The Three Types of Lightning Strikes Explained

Understanding how lightning affects your building is crucial for a complete claim.

A direct lightning strike hits your building head-on, causing immediate, obvious damage like burned roofs, cracked walls, fires, and fried electrical systems.

A near miss strike hits a nearby object, like a tree or utility pole. The massive electrical discharge creates powerful surges that travel through utility lines into your building, frying electronics, damaging wiring, and disabling HVAC or security systems.

The sneakiest type is a ground surge. When lightning strikes nearby ground, the current travels through the earth into your property via utility lines, plumbing, or the foundation. This causes widespread electrical damage and can create shockwaves that weaken concrete.

Common but Hidden Damages to Your Commercial Property

The real challenge is identifying what you can’t see. This hidden damage often costs more to repair.

- Electrical wiring can be compromised even if it looks fine. Surges melt insulation and damage panels, shortening the lifespan of your systems. Look for soot around outlets or burning smells.

- Concrete foundations and the rebar damage within them are serious long-term problems. Shockwaves create micro-fractures that can lead to instability months or years later.

- Plumbing pipes made of metal can conduct electricity. The current can burst pipes or damage connected water heaters and boilers. A shock from running water is a clear sign of this issue.

- HVAC systems are highly vulnerable due to their sensitive electronic controls, which are easily destroyed by power surges, leading to system failure or inefficiency.

- Latent electronic failure is frustrating. Components in security systems, computers, and building automation systems can be weakened by a surge and fail weeks or months later. Proving this connection to the original strike is nearly impossible without an expert assessment.

This hidden damage is why many property owners end up in disputes with their insurance companies. A public adjuster can help identify and document all these hidden damages, ensuring your lightning damage insurance claim covers the full scope of repairs.

Understanding Your Commercial Property Insurance Coverage

When lightning strikes, knowing what your commercial property insurance covers is critical. Most policies include lightning as a named peril, but the details matter.

Generally, your building coverage protects the physical structure—the roof, walls, and electrical systems. Your business personal property coverage handles contents like computers, HVAC controls, and other equipment destroyed by a power surge. For multifamily properties, business interruption coverage is vital, reimbursing lost rental income or relocation costs when damage forces a shutdown.

Also, understand your policy type. Actual Cash Value (ACV) pays the depreciated value of damaged items, while Replacement Cost Value (RCV) covers the full cost to replace them with new, comparable items. For expensive commercial systems, RCV offers far better protection.

Is Power Surge Damage from Lightning Covered?

This is where many lightning damage insurance claims get complicated. Yes, power surge damage from lightning is typically covered. However, insurers may dispute whether a surge was caused by lightning or another electrical issue, such as a problem with the utility company. They may try to deny the claim by attributing it to artificially generated surges.

An equipment breakdown coverage endorsement can be a game-changer. It offers broader protection for mechanical and electrical equipment against various types of power surges, often with lower deductibles and fewer restrictions.

Potential Exclusions and Limitations in Your Policy

Even comprehensive policies have limitations that can complicate your claim.

- Wear and tear exclusions are a common tactic. Insurers may argue damage is due to aging systems, not the strike, a frequent issue for older buildings.

- Per-item limits can cap coverage for specific equipment (e.g., $5,000 per computer), creating significant gaps for expensive commercial assets.

- Deductibles on commercial policies can be substantial ($5,000 to $25,000 or more), so understanding how they apply is crucial for budgeting repairs.

- Timely notification requirements (often 30-60 days) can be problematic for hidden damage. Proactive inspections after any suspected lightning event are key.

- Proving causation is often the biggest challenge, especially with near-miss or ground surge events. This is where expert evaluation and documentation become essential for protecting your claim.

Navigating the Lightning Damage Insurance Claim Process

When lightning strikes, taking the right steps from the beginning can make the difference between a smooth lightning damage insurance claim and months of frustration. This isn’t just about paperwork; it’s about building a compelling case that reflects the true scope of your damages.

Step 1: Immediate Actions After a Lightning Strike

Your actions in the first few hours are critical for safety and your claim.

- Safety always comes first. Evacuate and call 911 if you see fire, smell gas, or notice exposed wires. Wait for the all-clear from emergency responders before re-entering.

- Prevent further damage. Mitigate your losses by shutting off main breakers, tarping the roof to prevent water intrusion, or turning off water lines if pipes have burst. Keep all receipts for these emergency measures, as they are usually covered by your policy.

- Document everything. Thoroughly document all visible damage with photos and videos, inside and out. Capture everything from scorched outlets and cracked walls to malfunctioning equipment. Do not throw away any damaged items.

Step 2: Working with the Insurance Company’s Adjuster

Your insurer will assign their adjuster, who works for them, not you. Their job is to determine what the insurer will pay based on your policy.

You should be present for the adjuster’s inspection. Be prepared with your documentation to show them all identified damage. Answer their questions honestly but avoid speculation. Stick to the facts, as your statements will be recorded. The company adjuster’s assessment may be incomplete, often focusing on obvious damage while missing hidden electrical or structural issues. This is a common source of disputes.

Step 3: Filing Your Initial Lightning Damage Insurance Claim

Formally notify your insurer to begin the claims process.

- Contact your insurance company as soon as possible. Most policies have strict notification deadlines (often 30-60 days). Have your policy number, date of loss, and a description of the damage ready.

- Fill out the claim form with as much detail as possible, referencing your documentation. State that you are still assessing the full extent of the damage, as more issues may appear later.

- Keep detailed records of all communication with your insurer, noting dates, names, and discussion summaries. This log is invaluable if disputes arise.

Proving Your Claim: Documentation and Evidence is Key

For your lightning damage insurance claim, the burden of proof is on you. You must provide concrete evidence linking every bit of damage back to the storm, which is challenging for hidden or delayed damage. Insurers are trained to minimize claims, so building an ironclad case with comprehensive documentation is essential.

Essential Documentation for Your Lightning Damage Insurance Claim

Your documentation tells the complete story of your loss.

- Photographic and video evidence is foundational. Capture all damage, from close-ups of scorched outlets to wide shots showing the overall impact. Date-stamp everything to establish a clear timeline.

- An inventory of damaged assets should be exhaustively detailed. Include model numbers, purchase dates, and original costs to prevent disputes over value.

- Multiple repair estimates from qualified, licensed contractors are crucial. Itemized estimates protect you from lowball settlement offers.

- Maintenance records are your defense against insurer claims of pre-existing conditions or poor upkeep.

- Historical weather reports and lightning strike data scientifically prove a lightning event occurred at your location on the date of loss. For detailed scientific research on lightning detection, resources like the National Weather Service’s lightning science overview can provide additional credibility.

- Expert reports from licensed professionals are vital for linking hidden or complex damage directly to the lightning event, removing insurer skepticism.

What is a Lightning Loss Affidavit and When is it Required?

A lightning loss affidavit is a notarized, sworn statement from a qualified professional, like a licensed electrician, testifying that lightning caused the damage. This document provides expert testimony with legal weight, explaining the science behind the damage.

A lightning loss affidavit is crucial for proving causation in cases of near miss strikes, ground surge damage, and latent damage that appears months later. The affidavit connects the dots for skeptical adjusters. This document is your best defense against claim denials, turning questionable damage into expert-verified proof. For complex commercial properties, it’s often the key to a full settlement.

The Public Adjuster Path vs. an Insurance Claim Lawsuit

When your commercial property in a Texas city like Austin, Dallas, or Houston suffers lightning damage, you must decide how to handle the lightning damage insurance claim: go it alone, hire a public adjuster, or sue your insurer. As a manager of a commercial building, multifamily complex, or religious institution, your choice dramatically impacts your settlement and recovery time.

At Insurance Claim Recovery Support, we are public adjusters who work exclusively for policyholders, ensuring you get the maximum settlement without the need for litigation.

Why a Lawsuit Should Be Your Last Resort

While tempting, a lawsuit against your insurer should be a last resort.

- Time: A lawsuit can take years, while a public adjuster often resolves claims in months. Delays mean your property remains damaged and your business suffers.

- Cost: Litigation is expensive, with upfront legal fees and court costs eating into your final settlement.

- Stress: Lawsuits are emotionally draining and time-consuming, distracting you from your business.

- Uncertainty: The outcome of a lawsuit is never guaranteed, and even a win might yield a disappointing settlement after costs.

| Feature | Public Adjuster Path | Insurance Claim Lawsuit |

|---|---|---|

| Timeline | Weeks to a few months (typically faster) | Months to years (often protracted) |

| Cost | Contingency fee (percentage of settlement), no upfront | Significant upfront legal fees, court costs, expert witness fees |

| Stress | Much lower; adjuster handles complexities | Very high; emotionally and financially draining |

| Outcome | Negotiated settlement, focused on repair/recovery | Court judgment or settlement, highly uncertain |

| Control | Policyholder retains more control over decisions | Control shifts to legal team, formal proceedings |

How a Public Adjuster Strengthens Your Claim to Prevent Disputes

Our approach is to build a claim so strong that disputes and litigation are avoided.

- We build your claim from day one, identifying all damage, including hidden issues that company adjusters in places like Fort Worth, San Antonio, or Waco often miss.

- Expert evaluation is key. Our team understands complex lightning damage and finds what others overlook, significantly increasing your settlement.

- Detailed documentation is your best weapon. We handle all paperwork and prepare comprehensive estimates, making it difficult for insurers to dispute the claim.

- We speak the insurer’s language, using our expertise in policy and claim procedures to negotiate effectively.

- Preparation prevents disputes. By addressing potential objections upfront, we streamline the process for properties in areas like Round Rock, Georgetown, and Lakeway, achieving a fair resolution faster.

When you partner with us, you gain an advocate who handles the complexities of your claim while you focus on your business.

Frequently Asked Questions about Lightning Damage Claims

When dealing with a lightning damage insurance claim, property owners often have pressing questions. Here are answers to the most common concerns I’ve heard after handling hundreds of these complex claims across Texas.

How long do I have to file a lightning damage claim in Texas?

In Texas, policies typically require you to report a loss within 30 to 60 days. Missing this deadline can jeopardize your claim. However, for hidden damage, the clock may start when you reasonably find it (the “findy rule”). This is crucial for complex systems where damage appears later.

My advice? Report any suspected lightning damage immediately, even if you’re unsure of the full extent. Then, continue to document any newly finded damage as it appears. This protects you legally while giving you time to uncover all the hidden issues.

Can my insurance company deny a claim for a “near miss” strike?

Unfortunately, yes. Insurers often deny claims for near-miss or ground-surge events, arguing a lack of direct evidence that lightning hit your building. They might claim the damage was pre-existing or a coincidence.

To counter this, you need solid evidence: expert reports from licensed electricians, a lightning loss affidavit, and official weather data showing lightning activity at your location. A public adjuster specializes in gathering this evidence to build a rock-solid case that insurers cannot easily dismiss. We have successfully overturned many such denials by proving causation.

What is the difference between an insurance adjuster and a public adjuster?

This is the most important question you can ask.

An insurance adjuster (or company adjuster) works for the insurance company. Their job is to protect the company’s financial interests by minimizing claim payouts.

A public adjuster works exclusively for you, the policyholder. We are licensed advocates whose only goal is to maximize your settlement by thoroughly documenting all damage and negotiating aggressively on your behalf.

Relying on the company’s adjuster is like letting the opposing side’s lawyer represent you in court. A public adjuster levels the playing field, ensuring you’re not leaving money on the table due to missed damage or undervalued repairs on your lightning damage insurance claim.

Conclusion

A lightning damage insurance claim is one of the most complex challenges a commercial property owner can face. The damage extends far beyond what is immediately visible, creating a web of interconnected issues that insurance companies often underestimate or overlook entirely. The real challenge is uncovering hidden destruction—from foundation micro-fractures to latent electronic failures—that can lead to inadequate settlements.

Don’t accept an unfair offer or get trapped in a costly legal battle that drains resources and delays repairs. There is a better way to protect your investment.

At Insurance Claim Recovery Support LLC, our multi-state licensed public adjusters represent only policyholders, never insurance companies. We specialize in complex commercial and multifamily property claims across Texas, including Austin, Dallas, Fort Worth, San Antonio, and Houston.

Our proactive approach is to build an ironclad claim from day one. We identify all damage, document it carefully, and negotiate for the maximum settlement you deserve, preventing disputes and avoiding litigation. You’ve worked hard to build your property investment; you deserve every dollar your policy provides when disaster strikes.

Contact a Public Insurance Adjuster for a free consultation and let us help you steer this challenging process with confidence.