Why Understanding the Insurance Claim Process Texas is Critical for Property Owners

The Insurance Claim Process Texas can be overwhelming when your commercial property, apartment complex, or hotel suffers significant damage. Here’s what you need to know:

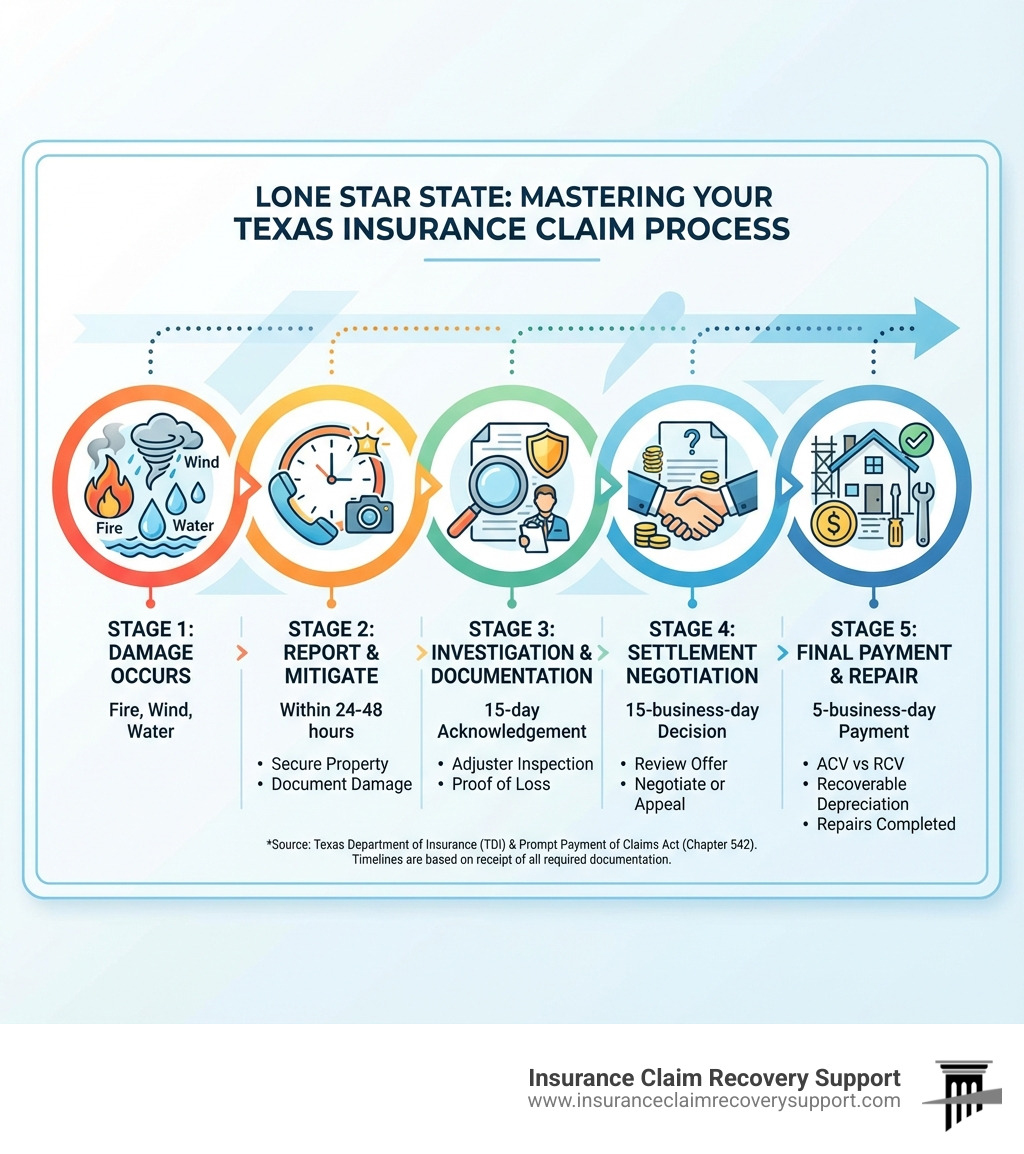

Key Steps in the Texas Insurance Claim Process:

- Report Immediately – Notify your insurer within your policy’s stated timeframe.

- Document Everything – Take photos, videos, and detailed notes of all damage.

- Mitigate Further Damage – Secure the property but don’t make permanent repairs yet.

- Know Your Timeline Rights – Texas law requires insurers to acknowledge claims within 15 days.

- Understand Payment Deadlines – Insurers must accept/reject within 15 business days after receiving all documentation and pay within 5 business days if approved.

Most commercial property owners file a major claim only once every 10-20 years. You’re navigating unfamiliar territory while dealing with business interruption and revenue loss. The insurance company’s adjuster handles claims daily and is trained to minimize payouts to protect the insurer’s bottom line.

Myth: You have to accept whatever the insurance company offers. ��

Fact: Settlement is a negotiation, and Texas law protects your right to fair compensation. ✅

In Texas, the Prompt Payment of Claims Act (Chapter 542) sets strict deadlines for insurers. Failure to comply can result in an 18% annual interest penalty, yet many property owners don’t know these protections exist.

As public adjusters, we at Insurance Claim Recovery Support have settled hundreds of millions of dollars in commercial and multifamily property damage claims across Texas. We steer the Insurance Claim Process Texas for clients who’ve been underpaid, delayed, or wrongfully denied, often increasing settlements significantly while helping property owners avoid unnecessary litigation.

Your Step-by-Step Guide to Navigating a Property Damage Claim in Texas

When disaster strikes your commercial property in Dallas, Houston, or Austin, knowing the initial steps can significantly impact your recovery. This guide will help you steer the Insurance Claim Process Texas efficiently and fairly.

Step 1: Immediate Actions After a Loss

Your actions immediately following property damage are critical.

- Ensure Safety & Mitigate Damage: First, ensure the safety of all occupants and evacuate if necessary. Then, take reasonable steps to prevent further damage as required by your policy, such as tarping a roof or shutting off water. Keep all receipts for these temporary repairs, as they are typically reimbursable.

- Document the Scene: Thoroughly document all damage with photos and video walkthroughs. Create a detailed inventory of damaged equipment, fixtures, and contents, including serial numbers and purchase dates if possible.

- Notify Your Insurer: Contact your insurance provider promptly with your policy number and the date of loss. Stick to the facts and avoid speculating on the cause or extent of the damage. Note who you spoke with and when.

- Avoid Permanent Repairs: Do not begin permanent repairs until the insurance company’s adjuster has inspected the damage.

Step 2: The Investigation & Your Rights Under the Texas Prompt Payment of Claims Act

The Texas Prompt Payment of Claims Act (Chapter 542) provides essential protections and deadlines for policyholders. You can review the Texas Department of Insurance consumer claim guidance for additional information about your rights.

- 15-Day Acknowledgment: After you report a loss, your insurer must acknowledge the claim and begin its investigation within 15 calendar days.

- 15-Business-Day Decision: Once the insurer receives all requested documentation (your “proof of loss”), it has 15 business days to accept or reject your claim.

- Extension Notice: Insurers can request a 45-day extension for complex cases but must notify you in writing with a valid reason.

- 5-Business-Day Payment: If your claim is approved, payment must be issued within 5 business days.

Failure to meet these deadlines can subject the insurer to an 18% annual interest penalty on your claim amount, plus attorneys’ fees.

Step 3: Documentation, Adjusters, and Proving Your Loss

Successfully navigating the Insurance Claim Process Texas hinges on meticulous documentation and understanding the roles of the professionals involved.

- Prove Your Loss: You will need to submit a sworn “Proof of Loss” form. Support it with your detailed property inventory, photos, videos, and receipts for temporary repairs.

- Get Independent Estimates: Obtain multiple, itemized estimates from reputable commercial contractors. These bids are vital for substantiating your claim and challenging a low valuation from the insurer.

- Understand the Adjusters: The insurance company’s adjuster works for them, with a goal to minimize the payout. A public adjuster, like Insurance Claim Recovery Support, is a licensed professional who works exclusively for you, the policyholder. We handle the entire claim process—from damage assessment to negotiation—to maximize your settlement and protect your interests. As a policyholder, you have the right to hire your own experts, including a public adjuster.

Overcoming Challenges in the Insurance Claim Process in Texas

Commercial property owners often face challenges like claim disputes, underpayments, or denials. Understanding how to overcome them is key to securing your full recovery.

What to Do When You Disagree with the Settlement Offer

An initial settlement offer is often a starting point for negotiation, not the final word. If you disagree with the offer:

- Request a written explanation of how the insurer calculated the figure.

- Provide your own evidence, including your documentation and independent contractor estimates, to support a higher amount.

- Negotiate with the adjuster by presenting your evidence and discussing the discrepancies.

- Invoke the appraisal clause in your policy. This dispute resolution process involves independent appraisers and a neutral umpire to determine the amount of loss, often avoiding litigation.

Be mindful of the statute of limitations: in Texas, you typically have two years from the date of loss or denial to file a lawsuit.

For additional background on Texas claim handling rules and consumer protections, review the Texas Department of Insurance consumer claim guidance.

Fact vs. Myth: Common Misconceptions for Property Owners

Navigating the Insurance Claim Process Texas is easier when you can separate fact from fiction.

| Feature | Company Adjuster | Public Adjuster |

|---|---|---|

| Employer | Insurance Company | Policyholder |

| Loyalty | Insurance Company | Policyholder |

| Goal | Minimize Payout / Protect Insurer’s Bottom Line | Maximize Payout / Protect Policyholder’s Investment |

| Fee Structure | Salaried by Insurer | Percentage of Settlement (typically 5-15% in Texas) |

Myth: You must accept the first offer.

Fact: A settlement is a negotiation. An initial offer is rarely final. With solid documentation, you can and should negotiate for the full amount you are owed.

Myth: You must use the insurer’s contractor.

Fact: You have the right to choose your own licensed contractor. It is wise to get multiple bids from contractors experienced with commercial property restoration.

Myth: Waiving a deductible is legal.

Fact: In Texas, it is illegal for a contractor to waive your deductible. This is considered insurance fraud, and you must pay your deductible as required by your policy.

For more information, you can learn more about consumer rights from the Texas Department of Insurance.

Public Adjuster vs. Insurance Claim Lawsuit: What’s Best for Your Property Damage Claim?

When a claim is underpaid or denied, you can hire a public adjuster or file a lawsuit. For property owners navigating the Insurance Claim Process Texas, a public adjuster is often the more efficient and effective path.

Why a Public Adjuster is Often Better Than a Lawsuit:

Our goal at Insurance Claim Recovery Support is to resolve your claim without litigation.

- Faster Resolution: A public adjuster focuses on negotiating a fair settlement quickly so you can repair your property and resume business. Lawsuits can take years.

- Less Adversarial: We work to maintain a professional dialogue with the insurer, avoiding the hostile relationship that litigation often creates.

- Cost-Effective: Public adjusters work on a contingency fee, which is a percentage of the settlement. This is typically less than the legal fees associated with a lawsuit, which can consume a large portion of your recovery.

- Proven Success: By expertly documenting the loss, interpreting policy language, and skillfully negotiating, we often secure fair settlements through negotiation or appraisal. Our 90% settlement success rate without unnecessary lawsuits demonstrates our effectiveness.

While we strive to avoid litigation, it may be necessary if an insurer acts in bad faith. In such cases, a public adjuster’s documentation provides critical support for your legal team and can streamline the lawsuit process if it becomes the only viable option.

Finalizing Your Claim and Securing Your Full Recovery

The final goal of the Insurance Claim Process Texas is to restore your property and get your business back to normal. This involves understanding payments, managing repairs, and closing the claim.

Understanding Payments, Deductibles, and Reopening a Claim

Navigating the financial aspects of your claim is crucial for a complete recovery.

- ACV vs. RCV: Most commercial policies provide Replacement Cost Value (RCV), the cost to replace items with new ones. Initially, you may receive the Actual Cash Value (ACV), which is the replacement cost minus depreciation. The withheld depreciation (recoverable depreciation) is paid after you complete repairs and provide receipts.

- Deductibles: This is the out-of-pocket amount you must pay before your insurance coverage applies. For commercial properties, this can be a flat amount or a percentage of the property’s value.

- Mortgage Company Involvement: If you have a loan, the claim check will likely be co-payable to your mortgage lender. The lender will hold the funds in escrow and release them as repairs are completed.

- Reopening a Claim & Supplemental Claims: If additional, hidden damage is finded after a claim is settled (e.g., structural issues found during repairs), you can often reopen the claim or file a supplemental claim to cover these new costs. Be mindful of the two-year statute of limitations.

How Insurance Claim Recovery Support Can Help

Navigating these complexities is where we excel. We ensure all damages are identified, track recoverable depreciation, and coordinate with lenders to ensure you receive every dollar you’re entitled to under your policy. From initial assessment to final payment, we are your dedicated advocates for a full and fair recovery.