- Public Insurance Adjusters

- admin@insuranceclaimrecoverysupport.com

- Call Us : 512-904-9900

- scott@insuranceclaimrecoverysupport.com

- Call Us : 512-904-9900

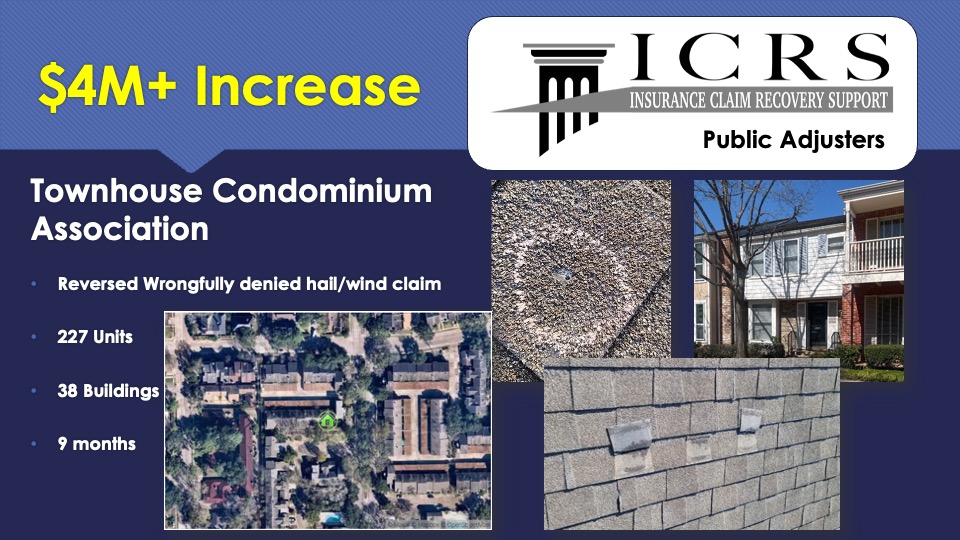

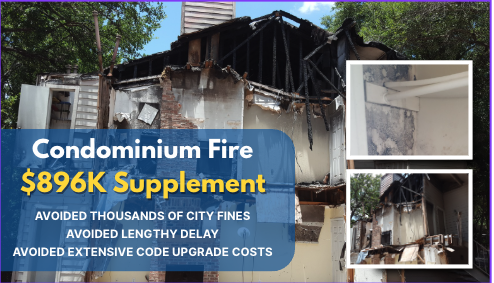

Homeowner associations (HOAs) and condominium boards are responsible for protecting shared community assets. When disaster strikes, navigating a complex property insurance claim can be overwhelming for board members and property management companies.

ICRS provides professional public adjusting services to ensure communities receive full and fair settlements, minimizing disputes and delays.

HOA boards and directors

Condominium associations

Property management companies serving HOAs and condos

Community associations for planned developments

Fire and smoke damage to shared structures

Hail damage to condominium roofs

Wind and tornado claims for HOA-managed assets

Flood and water damage to common areas

Freeze damage and pipe bursts in community buildings

Lightning and electrical losses

Vandalism and theft impacting shared spaces

Business interruption (clubhouses, amenities, rental income)

ICRS represents HOAs and condo associations in: Texas, Colorado, Florida, Georgia, Indiana, Kansas, Kentucky, Maryland, Nebraska, Nevada, North Carolina, Ohio, Oklahoma, Pennsylvania, South Carolina, and Utah.

☑ For HOA and condo claims exceeding $250,000, ICRS offers contingency-based public adjusting (no recovery, no fee).

☑ For smaller claims under $250,000, our ClaimNavigator service delivers affordable expert support for just $250

Join our mailing list to get the latest updates, news and special offers delivered directly to your inbox.