Understanding the Value of a Fire Claims Public Adjuster

A fire claims public adjuster is a licensed insurance professional who represents you—the policyholder—after fire damage to your property. Unlike insurance company adjusters who work for the insurer, public adjusters work exclusively for you to maximize your settlement.

“Insurance companies are in the business of making money, which means they have an incentive to pay out as little as possible on claims.”

Quick Guide to Fire Claims Public Adjusters:

| What They Do | Why You Need One | When to Hire |

|---|---|---|

| Document all fire, smoke, and water damage | Can increase payouts by up to 270% | Immediately after the fire |

| Interpret policy language in your favor | Work on contingency (no recovery, no fee) | When facing a lowball offer |

| Create detailed damage inventories | Typically charge 5-15% of settlement | If your claim is denied |

| Negotiate directly with insurance companies | Reduce your stress during recovery | For claims over $10,000 |

| Handle all claim communications | Identify hidden damage insurers miss | Before accepting any settlement |

After a fire, you’re dealing with emotional trauma, displacement, and property loss. The last thing you need is to battle with your insurance company over a fair settlement.

Key benefits of hiring a fire claims public adjuster:

- Expert advocacy: They understand policy language and insurer tactics

- Thorough documentation: They capture all damage, including hidden smoke and water issues

- Stress reduction: They handle communications while you focus on recovery

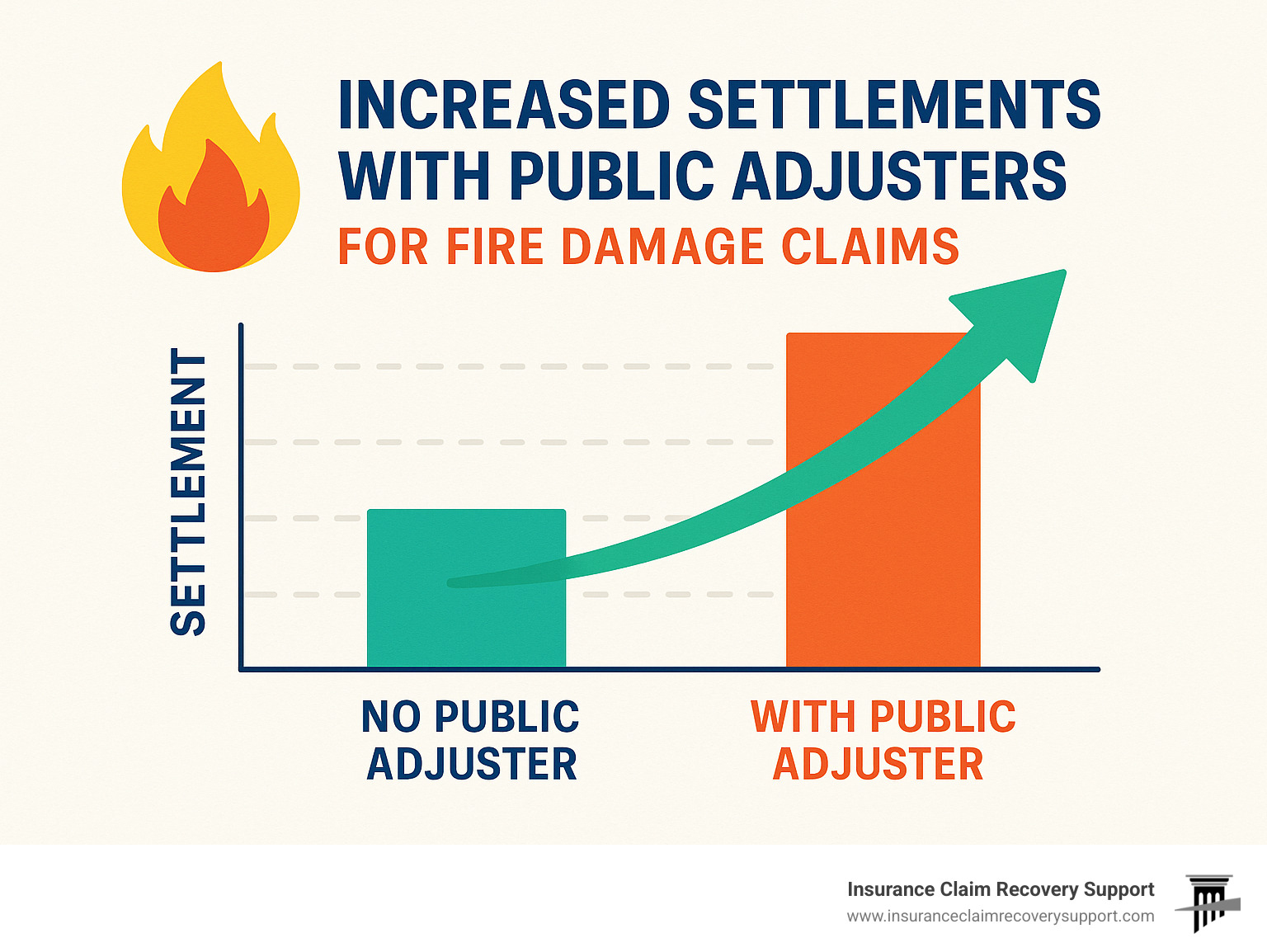

- Higher settlements: They typically secure 2-3 times the initial offer

- No upfront cost: They only get paid when you get paid

I’m Scott Friedson, a multi-state licensed fire claims public adjuster and CEO of Insurance Claim Recovery Support LLC, who has settled hundreds of millions in fire damage claims and increased payouts from 30% to 3,800% while helping policyholders avoid unnecessary litigation.

What Is a Fire Claims Public Adjuster?

When disaster strikes and fire damages your home or business, the road to recovery can feel overwhelming. This is where a fire claims public adjuster steps in – your personal advocate in the insurance claim process.

A fire claims public adjuster is a licensed professional who works exclusively for you, the policyholder. Unlike insurance company adjusters, these specialists have one mission: maximizing your settlement after a fire loss. They bring expertise in policy interpretation, thorough damage assessment, and skilled negotiation to your side of the table.

Here in Texas, where we help property owners from Austin to San Antonio, Dallas-Fort Worth to Houston, and communities like Lubbock, Waco, Georgetown, and Lakeway, public adjusters must meet strict licensing requirements through the Texas Department of Insurance. This ensures you’re working with qualified professionals who understand local building codes and regional concerns.

“After a fire, what you don’t see can be just as damaging as what you do see. Insurance companies often miss hidden damage that a trained eye will catch.”

When examining your property, a fire claims public adjuster looks beyond the obvious burn damage to identify:

- Smoke damage that silently infiltrates walls, ductwork, and electronics

- Water damage from firefighting efforts that can lead to mold and structural issues

- Structural weakening that might not be immediately visible

- Acidic soot deposits that cause ongoing corrosion

- Personal property and inventory losses that are easily overlooked

- Additional living expenses or business interruption costs you’re entitled to claim

The best part? Public adjusters work on contingency, typically charging between 5-15% of your final settlement. This means they only get paid when you get paid – creating perfect alignment with your interests.

Fire Claims Public Adjuster vs. Insurance Company Adjuster

Understanding the fundamental difference between these two types of adjusters is crucial for your claim’s success:

| Fire Claims Public Adjuster | Insurance Company Adjuster |

|---|---|

| Works exclusively for you | Works for the insurance company |

| Paid a percentage of your settlement | Paid a salary by the insurer |

| Goal: Maximize your recovery | Goal: Minimize company payout |

| Documents damage comprehensively | May overlook or undervalue damage |

| Interprets policy language in your favor | Interprets policy to limit coverage |

| Negotiates for full replacement costs | Often applies maximum depreciation |

| Identifies hidden damage and code upgrades | Focuses primarily on visible damage |

I once heard an insurance company adjuster tell a homeowner, “I don’t work for you; I work for the insurance company.” This honest statement reveals the inherent conflict of interest these adjusters face. They might be professional and courteous, but their paycheck comes from the company that profits when your claim payout is lower.

In contrast, a fire claims public adjuster has both a legal and ethical duty to represent only your interests – creating truly conflict-free representation that can dramatically improve your settlement.

Fire Claims Public Adjuster vs. Fire Claim Attorney

While both professionals can help after a fire loss, they serve different but complementary roles:

Fire Claims Public Adjuster:

– Specializes in policy interpretation and accurate damage valuation

– Creates detailed documentation and prepares comprehensive estimates

– Negotiates directly with insurance adjusters from day one

– Works on a modest contingency fee (typically 5-15% of settlement)

– Cannot provide legal representation or file lawsuits

– Gets involved from the beginning of the claim process

Fire Claim Attorney:

– Specializes in insurance law and litigation strategies

– Becomes necessary if your claim is denied or legal action is required

– Can file lawsuits and represent you in court proceedings

– Works on a higher contingency fee (typically 30-40% of settlement)

– May lack technical expertise in property damage assessment

– Often gets involved after negotiations have reached an impasse

For complex or high-value claims, some policyholders benefit from having both professionals on their team. A public adjuster handles the detailed documentation and initial negotiations, while an attorney stands ready if litigation becomes necessary – giving you comprehensive protection throughout the claim process.

Why & When to Hire a Fire Claims Public Adjuster

The aftermath of a fire is overwhelming. Between finding temporary housing, salvaging belongings, and dealing with the emotional impact, the last thing you need is to battle an insurance company that’s trying to minimize your payout.

Key Reasons to Hire a Fire Claims Public Adjuster:

-

Significantly Higher Settlements: Studies show that policyholders who use public adjusters receive up to 270% more than the insurance company’s initial offer. For large losses, this can mean hundreds of thousands of additional dollars.

-

Expert Knowledge: Insurance policies are complex legal documents filled with exclusions, limitations, and technical language. Public adjusters understand how to interpret these policies to maximize your coverage.

-

Comprehensive Damage Assessment: Many fire-related damages aren’t immediately visible. Smoke can penetrate walls and HVAC systems, while water from firefighting efforts can cause hidden mold and structural issues. Public adjusters know where to look and how to document these hidden damages.

-

Stress Reduction: After a fire, you need to focus on rebuilding your life, not arguing with insurance representatives. A public adjuster handles all communications, paperwork, and negotiations.

-

No Upfront Costs: Public adjusters work on contingency, meaning they only get paid when you get paid. This alignment of interests ensures they’re motivated to maximize your settlement.

One Austin homeowner we worked with initially received an offer of $34,000 from their insurer after a kitchen fire. After hiring us, the final settlement reached $70,000 – more than double the original offer – because we documented extensive smoke damage throughout the home that the insurance company’s adjuster had overlooked.

Red Flags Signaling You Need a Fire Claims Public Adjuster

Consider hiring a public adjuster immediately if you notice any of these warning signs:

-

Low Initial Settlement Offer: If the insurance company’s offer seems insufficient to cover the actual costs of repairs and replacements, it probably is.

-

Delays and Stalling Tactics: Insurance companies sometimes use delays to pressure desperate policyholders into accepting lower settlements.

-

Confusing or Complicated Explanations: If adjusters use technical jargon to explain why certain damages aren’t covered, a public adjuster can translate and challenge these assertions.

-

Pressure to Sign Documents Quickly: Never sign anything without understanding it fully. Insurance companies may rush you to accept a settlement before you realize its inadequacy.

-

Denial of Valid Claim Elements: If the insurer is denying coverage for items that should be covered under your policy, a public adjuster can help dispute these denials.

As one Houston client told us: “I was ready to accept the insurance company’s offer until my contractor told me it wasn’t nearly enough to repair the damage. The public adjuster found twice as much damage as the insurance company acknowledged.”

Optimal Timing in the Claim Lifecycle

While it’s ideal to hire a fire claims public adjuster immediately after a loss, they can help at various stages:

Immediately After the Fire:

– Ensures proper documentation from the start

– Helps secure the property to prevent further damage

– Assists with emergency expenses and temporary housing claims

– Sets up the claim correctly from day one

After the Insurance Company’s Initial Inspection:

– Reviews the insurer’s scope of damage for completeness

– Identifies overlooked or undervalued damages

– Challenges inappropriate depreciation calculations

– Prepares a comprehensive counteroffer

Upon Receiving a Low Settlement Offer or Denial:

– Analyzes the reasons for the low offer or denial

– Gathers additional documentation to support your claim

– Negotiates directly with higher-level insurance representatives

– Prepares for the appraisal process if necessary

For Reopening Previously Settled Claims:

– Identifies additional damages finded after settlement

– Documents supplemental claims for consideration

– Negotiates for additional payments based on new information

In Texas, there are statutory deadlines for filing claims and disputing settlements, so don’t wait too long to seek professional help.

Step-By-Step Fire Insurance Claim Process With a Fire Claims Public Adjuster

When you work with a fire claims public adjuster from Insurance Claim Recovery Support, we guide you through every step of the claim process:

1. Initial Assessment and Engagement

- Free consultation to evaluate your situation

- Review of your insurance policy to understand coverage

- Clear explanation of our contingency fee structure

- Signing of representation agreement

2. Securing the Scene and Mitigating Damage

- Arranging for emergency board-up and tarping to prevent further damage

- Documenting the property before any cleanup begins

- Coordinating with restoration companies if needed

- Ensuring all mitigation efforts are properly documented for reimbursement

3. Comprehensive Damage Documentation

- Detailed room-by-room inspection

- Professional photography and video documentation

- Identification of structural, cosmetic, and hidden damages

- Testing for smoke residue and water damage in non-obvious areas

As one San Antonio client finded, what appeared to be minor smoke damage in a bedroom actually required complete reconstruction due to smoke penetration in the insulation and ductwork – something the insurance company’s adjuster completely missed.

4. Detailed Inventory and Loss Valuation

- Complete inventory of damaged personal property

- Research to determine replacement costs for equivalent items

- Documentation of business inventory losses for commercial claims

- Calculation of business interruption losses where applicable

5. Policy Analysis and Claim Preparation

- Identification of all applicable coverages

- Assessment of code upgrade requirements

- Evaluation of additional living expense entitlements

- Preparation of a comprehensive claim package

6. Claim Submission and Negotiation

- Formal presentation of the claim to the insurance company

- Direct negotiation with insurance adjusters

- Addressing and rebutting any coverage disputes

- Persistent follow-up to prevent delays

7. Settlement and Payment

- Review of settlement offers for completeness

- Negotiation of final terms

- Assistance with payment processing

- Guidance on the restoration and rebuilding process

Documentation & Evidence a Fire Claims Public Adjuster Collects

The strength of your fire claim depends largely on the quality and completeness of your documentation. A fire claims public adjuster collects:

Photographic and Video Evidence:

– High-resolution photos of all damaged areas

– Video walkthroughs showing the extent of damage

– Close-up documentation of smoke residue and water damage

– Before and after comparisons where available

Official Reports and Records:

– Fire department incident reports

– Building inspector assessments

– Environmental testing results (for smoke, soot, and water damage)

– Weather reports if relevant (for lightning-caused fires)

Financial Documentation:

– Original purchase receipts for damaged items

– Contractor estimates for repairs

– Receipts for emergency expenses

– Temporary housing costs

– Business interruption records for commercial claims

Expert Assessments:

– Structural engineer reports

– HVAC system evaluations

– Electrical system inspections

– Environmental testing for smoke and soot contamination

Policy Documentation:

– Complete insurance policy with all endorsements

– Prior claim history if relevant

– Proof of premium payments

– All correspondence with the insurance company

In a recent Round Rock claim, our detailed documentation of smoke damage throughout the HVAC system resulted in a $45,000 increase in the settlement amount – funds that were essential for proper remediation.

How Fire Claims Public Adjusters Negotiate With Insurers

Effective negotiation is an art form that combines technical knowledge, communication skills, and persistence. Here’s how professional fire claims public adjusters approach negotiations:

-

Detailed Line-Item Estimates: Using industry-standard software like Xactimate, public adjusters create comprehensive estimates that account for every aspect of restoration, from demolition to finishing touches.

-

Code Compliance Documentation: They identify all building code upgrades required during reconstruction and ensure these costs are included in the claim.

-

Strategic Communication: They maintain professional relationships with insurance representatives while firmly advocating for your interests, knowing when to escalate issues to supervisors or managers.

-

Addressing Depreciation: They challenge excessive depreciation calculations and push for replacement cost value rather than actual cash value where the policy allows.

-

Leveraging Policy Language: They cite specific policy provisions to counter claim denials or limitations.

-

Persistence and Follow-Up: They maintain consistent pressure on the insurance company, preventing your claim from being delayed or forgotten.

One Dallas business owner told us: “The insurance company’s adjuster spent an hour at my restaurant after the fire. Your public adjuster spent three days documenting every single item. The difference in the settlement was over $200,000.”

Fire Claims Public Adjuster & Reopened or Denied Claims

Even if your claim has been denied or you’ve already accepted a settlement, a fire claims public adjuster may still be able to help:

For Denied Claims:

– Analyzing the denial letter to identify the basis for denial

– Gathering evidence to counter the insurance company’s position

– Preparing a detailed appeal with supporting documentation

– Requesting reconsideration based on new evidence

For Reopened Claims:

– Identifying damages finded after the initial settlement

– Documenting these additional damages thoroughly

– Preparing supplemental claims for consideration

– Negotiating for additional payments

For Disputed Claims:

– Preparing for the appraisal process outlined in most policies

– Representing you during mediation or appraisal hearings

– Working with attorneys if litigation becomes necessary

– Providing expert testimony if required

A Fort Worth homeowner had accepted a $75,000 settlement for fire damage before consulting us. We were able to reopen the claim and document significant smoke damage in areas not included in the original scope, ultimately securing an additional $95,000 for our client.

Fees, Licensing & How to Choose the Right Fire Claims Public Adjuster

Selecting the perfect fire claims public adjuster might feel overwhelming, but understanding their fees, licensing, and qualifications will help you make a confident choice during this stressful time.

Fee Structure

Fire claims public adjusters work on a contingency basis—meaning you don’t pay unless they recover money for you. In Texas, these fees are regulated to protect consumers:

- 5-10% for larger commercial fire losses

- 10-15% for residential and smaller commercial fire claims

The specific percentage depends on several factors, including how complex your claim is, the total damage value, when you bring the adjuster on board, and how much work they’ll need to do.

While seeing a percentage of your settlement go to your adjuster might give you pause, research consistently shows that even after paying their fee, policyholders who use public adjusters typically receive settlements 2-3 times higher than initial offers. One of our Austin clients initially received a $45,000 offer but ended up with a $120,000 settlement after our involvement—more than making up for our fee.

Licensing Requirements

Texas takes public adjuster licensing seriously to protect homeowners. To practice legally, fire claims public adjusters must:

- Pass a comprehensive state examination

- Complete ongoing education requirements

- Maintain a surety bond for client protection

- Follow a strict professional ethics code

- Register with the Texas Department of Insurance

Before hiring anyone, take a moment to verify their license through the Texas Department of Insurance website. A legitimate adjuster will happily provide their license number and encourage you to check their credentials.

How to Choose the Right Fire Claims Public Adjuster

Finding the right partner for your fire claim journey makes all the difference. Here’s what to look for:

Specialized Experience: Look for adjusters who specifically handle fire claims rather than generalists. Fire damage has unique complexities—from hidden smoke damage to water damage from firefighting efforts—that require specialized knowledge.

Local Expertise: A fire claims public adjuster who knows the San Antonio building codes will serve you better if you live there than someone unfamiliar with local regulations. Whether you’re in Houston, Dallas-Fort Worth, or a smaller community like Georgetown or Lakeway, local knowledge matters.

Client References: Don’t hesitate to ask for references from previous fire claim clients. A confident adjuster will happily connect you with satisfied customers who’ve been through similar situations.

Professional Affiliations: Membership in organizations like the National Association of Public Insurance Adjusters (NAPIA) signals a commitment to ongoing education and ethical standards.

One of our Waco clients shared: “What truly made the difference wasn’t just their insurance knowledge—it was how they took time to understand what items held sentimental value for our family after the fire. They fought for things the insurance company wanted to dismiss as worthless that meant the world to us.”

For more information about our public insurance adjuster services, click here.

Qualifications Checklist for a Fire Claims Public Adjuster

When interviewing potential adjusters, consider asking these essential questions:

“Can you share your Texas license number?” (Always verify this)

“How many years have you specialized in fire claims?”

“Have you handled claims in my area before?”

“How familiar are you with our local building codes?”

“What’s your approach to documenting smoke and water damage?”

“How will we communicate throughout the process?”

“Can you explain exactly how your fee structure works?”

A qualified fire claims public adjuster will answer these questions confidently and transparently. They’ll make complex insurance concepts understandable and give you a clear picture of what to expect.

Understanding the Public Adjuster Contract

Before signing with any adjuster, make sure you clearly understand these key elements of their contract:

Fee Percentage: The exact percentage they’ll receive should be clearly stated—no hidden surprises.

Service Scope: What specific services will they provide? Will they handle everything from documentation to final negotiation?

Termination Options: Under what circumstances can either party end the relationship? A fair contract protects both sides.

Payment Timing: When and how will the adjuster receive payment? Typically, this happens after you receive your settlement.

Ethical Commitments: The contract should clearly state their obligation to represent your best interests.

A trustworthy fire claims public adjuster will walk you through each contract element with patience, ensuring you’re completely comfortable before signing anything. They understand you’re making this decision during one of life’s most stressful experiences and will give you the time and information you need.

Maximizing Settlements & Preventing Claim Denials

To secure the maximum settlement for your fire damage claim, understanding common denial reasons and proven strategies is essential.

Common Reasons Fire Claims Are Denied or Underpaid

-

Coverage Exclusions: Insurance policies contain specific exclusions. For example, if the fire resulted from an excluded cause like arson by the policyholder, the claim may be denied.

-

Non-Payment of Premiums: If your policy lapsed due to missed payments before the fire, your claim will likely be denied.

-

Misrepresentation or Underreporting: If you provided incorrect information when purchasing the policy or failed to disclose significant property changes, the insurer may deny coverage.

-

Failure to Mitigate Damage: Policyholders have a duty to take reasonable steps to prevent further damage after a fire. Failure to board up windows or tarp a damaged roof could result in reduced payment.

-

Insufficient Documentation: Without proper evidence of the pre-loss condition and post-loss damage, insurers may undervalue or deny portions of your claim.

A Houston business owner faced a claim denial after a kitchen fire because the insurance company alleged he had misrepresented the building’s fire suppression system on his application. Our investigation revealed this was a clerical error by the insurance agent, and we successfully appealed the denial, securing a $175,000 settlement.

Proven Strategies Used by Fire Claims Public Adjusters

Professional fire claims public adjusters employ these strategies to maximize settlements:

-

Comprehensive Documentation: Creating a thorough inventory of all damaged items, including those with smoke or water damage that might not be immediately apparent.

-

Expert Consultations: Bringing in specialists like structural engineers, industrial hygienists, and restoration experts to document specific damages that require professional assessment.

-

Code Upgrade Identification: Researching local building codes to ensure all required upgrades during reconstruction are included in the claim.

-

Policy Maximization: Identifying all applicable coverages, including often-overlooked provisions like ordinance and law coverage, debris removal, landscaping, and additional living expenses.

-

Strategic Timing: Knowing when to push for advances and when to hold out for better offers.

-

Detailed Line-Item Estimating: Creating estimates that account for every aspect of restoration, from demolition to finishing touches.

-

Effective Counterarguments: Preparing evidence-based responses to common insurer tactics for reducing settlements.

According to the National Fire Protection Association, residential fires caused approximately $8.6 billion in property damage in 2020. Yet many homeowners recover only a fraction of their actual losses because they don’t know how to steer the claims process effectively.

One San Antonio family we worked with initially received an offer that didn’t account for extensive smoke damage throughout their HVAC system. By bringing in specialized testing equipment, we documented dangerous levels of soot in areas the insurance company’s adjuster never examined, resulting in a settlement increase of over $65,000.

“The public adjuster found twice as much damage as the insurance company acknowledged. Without their help, I would have been left with a half-repaired home and no more insurance funds.”

For commercial properties, business interruption calculations are particularly complex. A Dallas restaurant owner was offered just two months of business interruption coverage after a kitchen fire. Our detailed financial analysis demonstrated that the restoration timeline and subsequent ramp-up period would actually require six months of coverage, tripling that portion of the settlement.

Frequently Asked Questions About Fire Claims Public Adjusters

What does a fire claims public adjuster cost?

When you’re dealing with the aftermath of a fire, cost concerns are completely natural. Fire claims public adjusters typically work on a contingency fee basis, meaning they only get paid when you do. In Texas, these fees generally range from 5-15% of your final settlement amount and are regulated by the Texas Department of Insurance.

For larger commercial losses, you’ll usually see fees on the lower end (around 5-10%), while residential claims typically fall between 10-15%. This might initially sound like a lot, but here’s the reality: most people end up with significantly more money even after paying this fee.

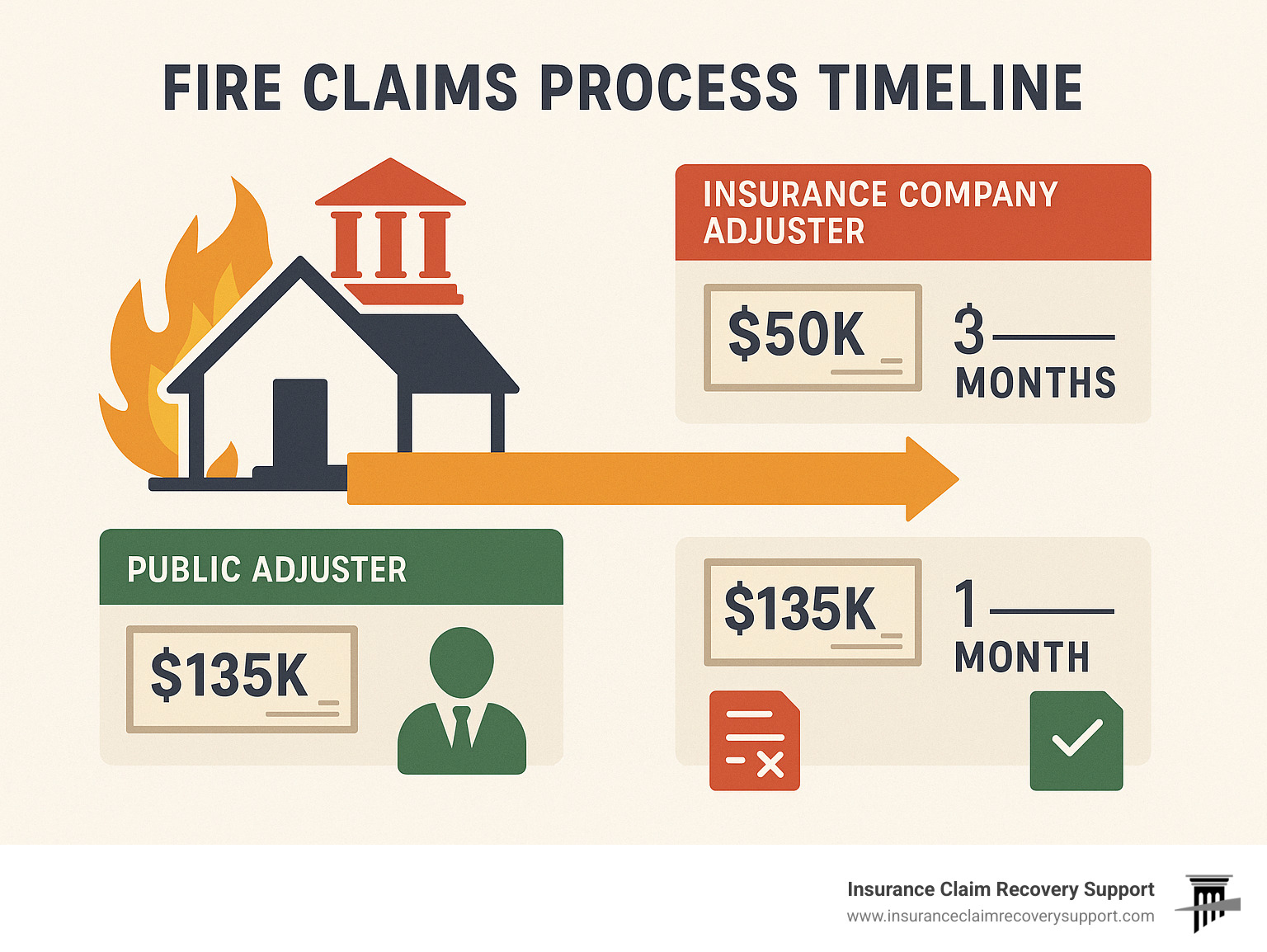

Let me share a real example from a family we helped in Austin. Their insurance company initially offered $50,000 for fire damage to their home. After bringing us on board, we documented extensive hidden smoke damage and secured a $150,000 settlement. Our 10% fee was $15,000, leaving them with $135,000 – that’s $85,000 more than they would have received on their own.

As one client told us, “I was hesitant about the fee until I saw what they recovered. It was like hiring someone for $15,000 who handed me back $85,000 in return.”

Can a fire claims public adjuster help after my claim was closed?

Yes! This is a question we hear often, and I’m happy to say that in many cases, we absolutely can help with closed claims.

Several situations might warrant reopening a fire claim:

Hidden damage that wasn’t apparent during initial inspections often surfaces weeks or months later. Smoke damage is particularly sneaky, sometimes working its way into wall cavities, HVAC systems, and electronics over time.

New evidence might emerge that affects your claim’s value. Perhaps a contractor finded structural weaknesses while beginning repairs, or specialized testing revealed soot contamination in areas that weren’t previously inspected.

Supplemental claims are common in fire restoration when additional damage is finded during repairs. Insurance companies expect these and have processes to handle them.

I remember working with a family in Georgetown who had already accepted a settlement for their kitchen fire. Three months later, they noticed strange odors coming from their ventilation system. We were able to document extensive smoke contamination in their attic insulation and secured an additional $28,000 for proper remediation.

Be aware that Texas has statutory deadlines for reopening claims or filing supplements. The sooner you reach out for help, the better your chances of success.

Do I need both a fire claims public adjuster and an attorney?

Not always, but sometimes this powerful combination provides the strongest advocacy for complex claims. Think of it this way: fire claims public adjusters are technical experts in damage assessment and policy interpretation, while attorneys specialize in legal remedies when negotiations fail.

For most standard claims, a public adjuster alone can effectively handle the documentation, valuation, and negotiation. We excel at navigating the claims process from day one, ensuring everything is properly documented and valued.

Attorneys become essential when your claim has been denied outright, when bad faith issues arise, or when the statute of limitations is approaching and immediate legal action is required. They bring the threat of litigation, which sometimes gets insurers’ attention in a way nothing else will.

Some situations benefit from having both professionals on your team:

When facing complex, high-value claims, the technical expertise of a public adjuster combined with the legal knowledge of an attorney creates a formidable advocacy team. I’ve seen this partnership work wonders for commercial clients with multi-million dollar losses.

When negotiations stall despite solid documentation, an attorney can provide the legal leverage needed to break the impasse while the public adjuster continues handling the technical aspects.

As one San Antonio business owner told us, “Having both professionals working together gave me confidence that no stone would be left unturned in fighting for what I deserved.”

For more information about our public insurance adjuster services, click here.

Conclusion

When fire strikes your home or business in Texas, the path to recovery begins with your insurance claim. The difference between a fair settlement and a financial struggle often comes down to having the right expertise on your side.

A fire claims public adjuster serves as your advocate throughout this challenging process, leveraging specialized knowledge of insurance policies, damage assessment, and negotiation strategies to maximize your settlement. From Austin to Dallas, Houston to San Antonio, and everywhere in between, Insurance Claim Recovery Support is committed to helping Texas policyholders recover fully from fire losses.

The statistics tell a compelling story: policyholders who work with public adjusters typically receive settlements that are 2-3 times higher than initial offers, even after accounting for the adjuster’s fee. This difference isn’t just about numbers—it’s about returning to normalcy and rebuilding your life without cutting corners.

Remember these key points as you steer your fire claim:

Act quickly after a fire to document damage before cleanup begins. Those first hours and days are critical for preserving evidence of your loss. Take photos, make lists, and secure your property against further damage.

Understand that insurance company adjusters work for the insurer, not for you. While they may be professional and courteous, their primary loyalty lies with their employer, whose profits increase when they pay less on claims.

Consider hiring a public adjuster before accepting any settlement offer. Once you’ve signed an acceptance, it becomes much harder to reopen your claim if you later find additional damage.

Look for a licensed, experienced adjuster with specific fire claim expertise. The unique challenges of fire claims—from smoke damage to code compliance issues—require specialized knowledge.

When you work with a qualified fire claims public adjuster, you can expect comprehensive documentation, thorough policy analysis, and persistent negotiation on your behalf while you focus on putting your life back together.

As one of our clients from Lakeway shared after a devastating house fire: “The insurance company wanted to patch things up. The public adjuster made sure everything was restored properly. The difference wasn’t just in dollars – it was in getting our home back the way it should be.”

Don’t settle for less than you deserve. When fire damages your property, make sure you have a dedicated advocate fighting for your full recovery.

For more information about our public insurance adjuster services, click here.