Why Understanding the Fire Claim Process Matters After Property Damage

The fire insurance claim process can feel overwhelming when your commercial building, multifamily complex, or religious institution is damaged. Navigating policies, documenting losses, and negotiating with insurers is complex, and mistakes can cost you thousands in your settlement. Fire damage extends beyond visible flames to include smoke in HVAC systems, hidden soot, water damage from firefighting, and compromised structural integrity. Initial insurance offers often miss these hidden damages, leading to underpayment and disputes.

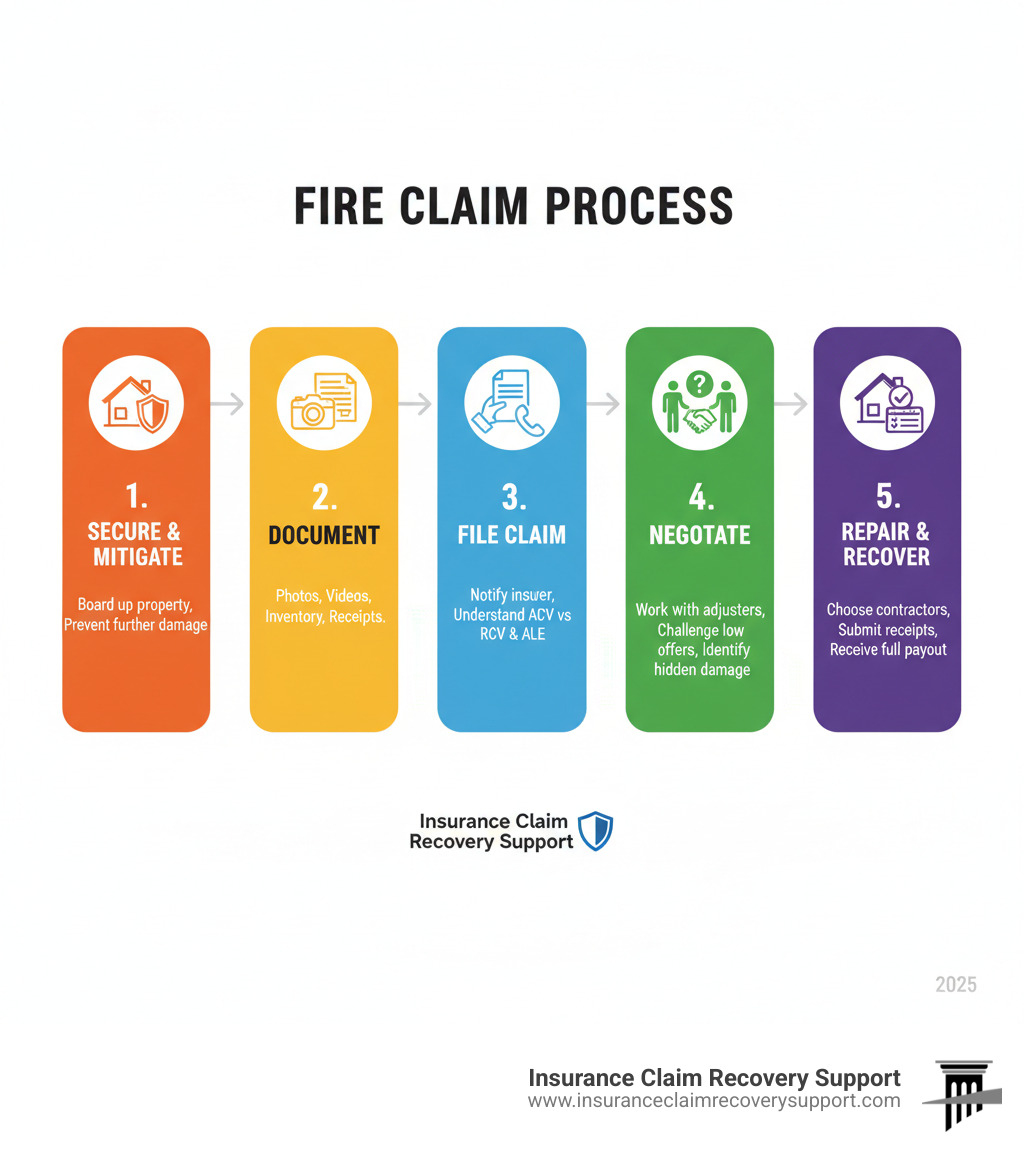

Quick Answer: The Fire Claim Process in 5 Steps

- Secure & Mitigate – Ensure safety, board up the property, prevent further damage

- Document Everything – Take photos/videos, create inventory, gather receipts and reports

- File Your Claim – Notify insurer immediately, understand your coverage (ACV vs. RCV, ALE, debris removal)

- Negotiate Settlement – Work with adjusters, challenge low offers, address hidden damage (smoke, soot, structural)

- Repair & Recover – Choose contractors, submit final receipts, receive full payout including depreciation holdback

Common Fire Claim Questions:

Q: How long do I have to file?

A: Most policies require notification within 24-48 hours. Delays can jeopardize your claim.

Q: What if my claim is denied or undervalued?

A: You have the right to appeal, hire a public adjuster, or pursue dispute resolution—litigation should be a last resort.

Q: Can I choose my own contractors?

A: Yes. You’re not required to use insurer-recommended contractors.

Q: What’s the difference between ACV and Replacement Cost?

A: ACV pays current value minus depreciation. Replacement Cost pays to rebuild/replace at today’s prices (depreciation recovered after repairs).

The claim process involves extensive back-and-forth with the insurer’s adjuster, and their settlement offers may be based on low contractor rates. This is where professional advocacy becomes critical to maximize your settlement and avoid the stress of litigation. I’m Scott Friedson, CEO of Insurance Claim Recovery Support. For 15 years, I’ve helped property owners steer complex fire claims, securing fair settlements and avoiding common pitfalls that lead to underpayment or denial.

Navigating the Commercial Fire Claim Process Step-by-Step

When fire strikes your commercial property, the path forward can seem murky. Understanding each phase is your roadmap to recovery. Let’s walk through the steps to move forward with confidence.

Immediate Actions & Damage Mitigation

After a fire, your immediate actions are critical for safety and protecting your claim. Once the fire department declares the site safe, you have a “duty to mitigate” further damage. This means taking reasonable steps to prevent additional loss, and these costs are typically covered by your policy. For guidance, you can consult resources like FEMA’s guide on what to do after a fire.

Your primary tasks are:

- Secure the Property: Board up broken windows and doors. Tarp damaged roofs to prevent weather damage, vandalism, and theft.

- Address Water Damage: Firefighting leaves behind significant water. Immediate drying is essential to prevent mold growth, which can start within 24-48 hours. Preventing mold is far better than filing a separate Fire Mold claim later.

- Notify Your Insurer: Report the fire within 24-48 hours. You don’t need all the details, just the basic facts.

- Request an Advance: If your property is uninhabitable, ask for an advance on your Additional Living Expenses (ALE) or Loss of Use coverage to cover temporary relocation or lost rental income.

For a detailed guide, use our Fire Mitigation Companies Due Diligence Checklist for Policyholders.

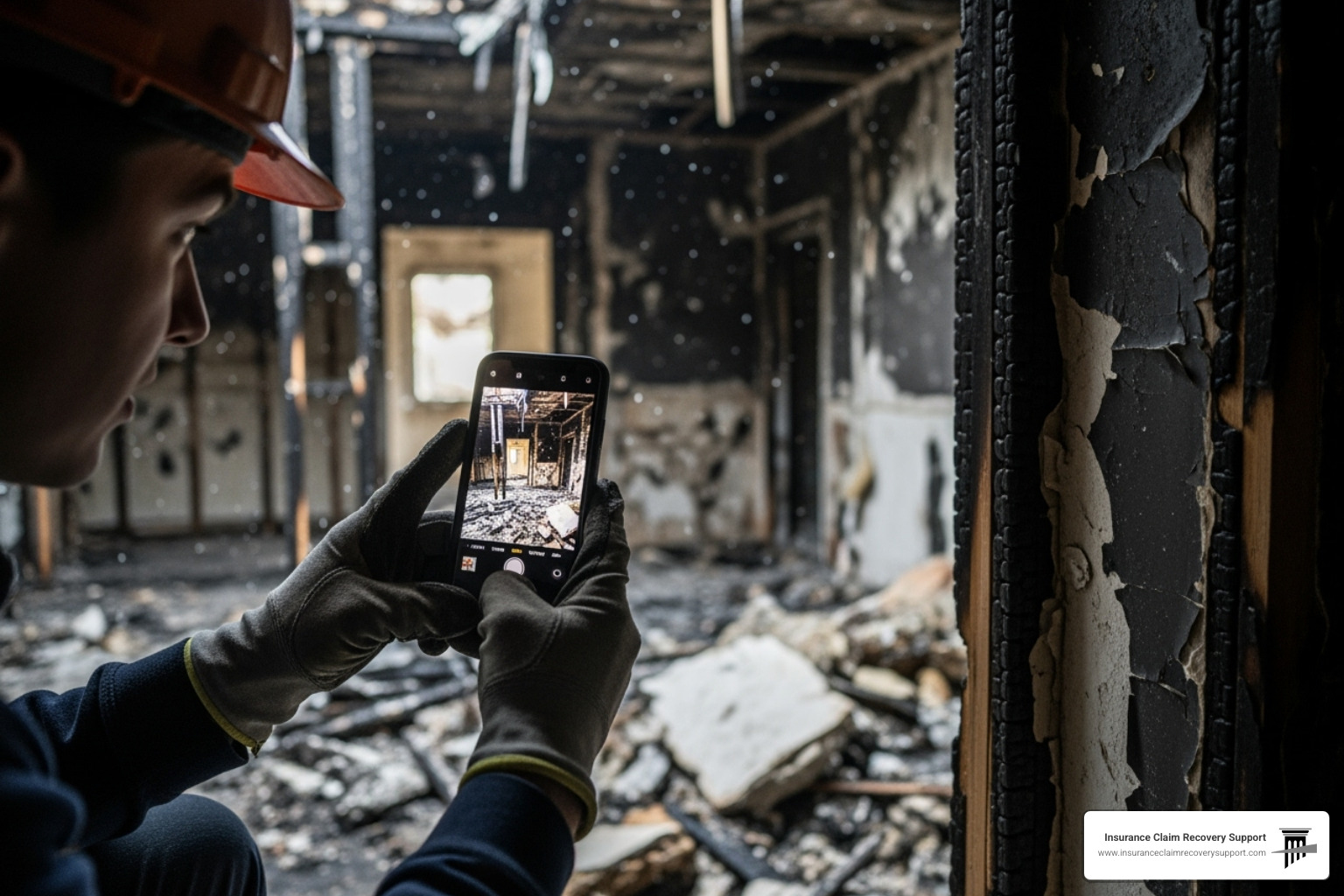

Documentation: Building Your Case

Thorough documentation is the foundation of your claim.

Once it’s safe, document everything. Take wide-angle photos of the overall damage and close-ups of specific items. A narrated video walkthrough is a powerful, indisputable record. Pay special attention to hidden damage like soot in HVAC systems or water damage in floor voids.

Next, create a detailed inventory, or Schedule of Loss. For each item, list its description, age, original cost, and estimated replacement cost. While tedious, this is essential for a fair settlement.

Gather proof of ownership, including receipts, warranties, and pre-fire photos. For commercial properties in Houston with specialized equipment, these records are invaluable. Keep a file with your full insurance policy, the fire report, multiple itemized repair estimates, and all receipts for fire-related expenses.

Understanding Your Policy & the Assessment

Your insurance policy is a complex contract. Here are the key terms you need to know:

- Actual Cash Value (ACV) vs. Replacement Cost Value (RCV): ACV pays the depreciated value of your property. RCV pays the cost to replace it new, but the depreciation amount (the holdback) is only paid after you complete repairs and show receipts.

- Building & Personal Property Coverage: This covers the physical structure and your contents (inventory, equipment, furniture).

- Additional Living Expenses (ALE) / Loss of Use: This covers increased costs if your property is uninhabitable, such as lost rental income for an apartment complex or temporary office space for a business in Austin.

- Debris Removal: This separate coverage pays to clear fire debris so rebuilding can begin.

- Code Upgrade Coverage: This vital coverage pays the extra cost to bring your property up to current building codes during reconstruction. Without it, you pay this out-of-pocket.

The insurer’s adjuster works for the insurance company. Their assessment may not capture the full extent of the damage. Fire damage is complex; intense heat can compromise structural integrity, and smoke and soot can cause corrosion and contamination in hidden areas like wall cavities and conduit systems. An adjuster’s quick walkthrough can easily miss these issues, leading to an undervalued claim.

Common Problems & How to Overcome Them

Navigating a large fire claim often involves frustrating obstacles.

- Delays, Denials, and Lowball Offers: Insurers may use delays to pressure you into accepting a lower settlement. Denials can occur for many reasons, from late notification to policy exclusions. Undervalued repair estimates are the most common issue, often based on the insurer’s preferred contractor rates, which are lower than market rates.

- Disagreements on Scope: You and the adjuster may disagree on the extent of damage or the necessity of certain repairs.

- Bad Faith: While most insurers are fair, some engage in bad faith tactics like unreasonable delays or unjustified denials. If you suspect this, it’s time to seek Fire Damage Claim Help.

Q: What if we disagree with the adjuster’s offer?

A: Don’t accept the first offer if it’s too low. Present your documentation, including photos, inventory lists, and independent repair estimates. If the insurer won’t budge, it’s time to bring in a public adjuster to advocate on your behalf.

Q: Why was our claim denied?

A: Request a detailed written explanation. Denials often stem from documentation gaps or misunderstood policy terms. Many can be successfully appealed with professional advocacy and a well-prepared counter-argument.

Myth vs. Fact

- Myth: You must use the insurer’s contractors.

Fact: You can select your own qualified, licensed restoration and construction teams. - Myth: The first offer is final.

Fact: You can negotiate—strong documentation and independent estimates often increase settlements. - Myth: Hiring a lawyer is the first step.

Fact: Most disputes can be resolved through public adjusting, appraisal, or negotiation. Litigation is a last resort.

Securing a Fair Settlement: Public Adjuster vs. Litigation

To get a fair settlement, you need to level the playing field. The insurance adjuster works for the insurance company, with their bottom line in mind. A public adjuster works exclusively for you, the policyholder. We are your advocate, handling documentation, assessing damage, and negotiating to maximize your settlement. This Fire Claims Public Adjuster advocacy is a game-changer.

How the paths compare for commercial and multifamily owners in Texas:

- Public Adjuster Path: Typically weeks to months; contingent fee; collaborative negotiations; expert documentation; helps you avoid unnecessary litigation.

- Lawsuit Path: Often months to years; legal fees and findy costs; depositions and court deadlines; higher stress and uncertainty. Best reserved for true bad faith or impasses.

Hire a public adjuster early in the process for large or complex claims. We specialize in property damage adjustment and negotiation. You may need an insurance lawyer only if the claim is denied in bad faith or if litigation becomes unavoidable.

The Final Steps: Repair, Rebuilding, and Final Payout

Once you reach a settlement, the final phase is restoration.

- Choose Your Own Contractors: You are not required to use the insurer’s recommended vendors. Select your own licensed, insured contractors with specific experience in fire damage restoration. Always check references and get multiple bids.

- Review Estimates: Ensure all repair estimates are itemized and reflect the agreed-upon scope of work with materials of similar kind and quality.

- Manage Rebuilding: The rebuilding process can be lengthy. Stay in regular contact with your contractors and ensure all work adheres to current local building codes, especially if you’re rebuilding in a city like Waco or Round Rock.

- Recover Your Holdback: Keep meticulous records of all repair expenses. Submit final receipts to your insurer to recover the depreciation holdback (the difference between ACV and RCV). This can be a significant portion of your total settlement.

Once all work is complete, final payments will be processed. For property owners in Houston, our team provides expert guidance through this entire process. Learn more about More info about fire damage claims in Houston.

Your Partner in Recovery

The insurance claim process after a fire is complex, but you don’t have to face it alone. When fire damages your commercial building, multifamily complex, or religious institution, you’re up against an insurance system designed to protect the insurer’s interests. While a proactive approach and thorough documentation are crucial, you’re an expert in your field—not in negotiating with adjusters who handle claims daily.

This is where professional advocacy is essential. As public adjusters at Insurance Claim Recovery Support, we represent only policyholders, never insurance companies. We are fluent in policy language and know the tactics used to minimize payouts. Our expertise allows us to present your claim to maximize your settlement and help you avoid unnecessary litigation by resolving disputes proactively.

We’ve helped property owners across Texas—from Austin, Dallas-Fort Worth, and Houston to San Antonio, Lubbock, San Angelo, Amarillo, Waco, Round Rock, Georgetown, and Lakeway—recover fair settlements on complex losses. Let us handle the insurance complexities so you can focus on what matters: your tenants, your congregation, or your business.

If your property has suffered fire damage, contact us today for a free claim review. Find a public adjuster near you and take the first step toward a full recovery. You deserve an advocate who fights exclusively for you.