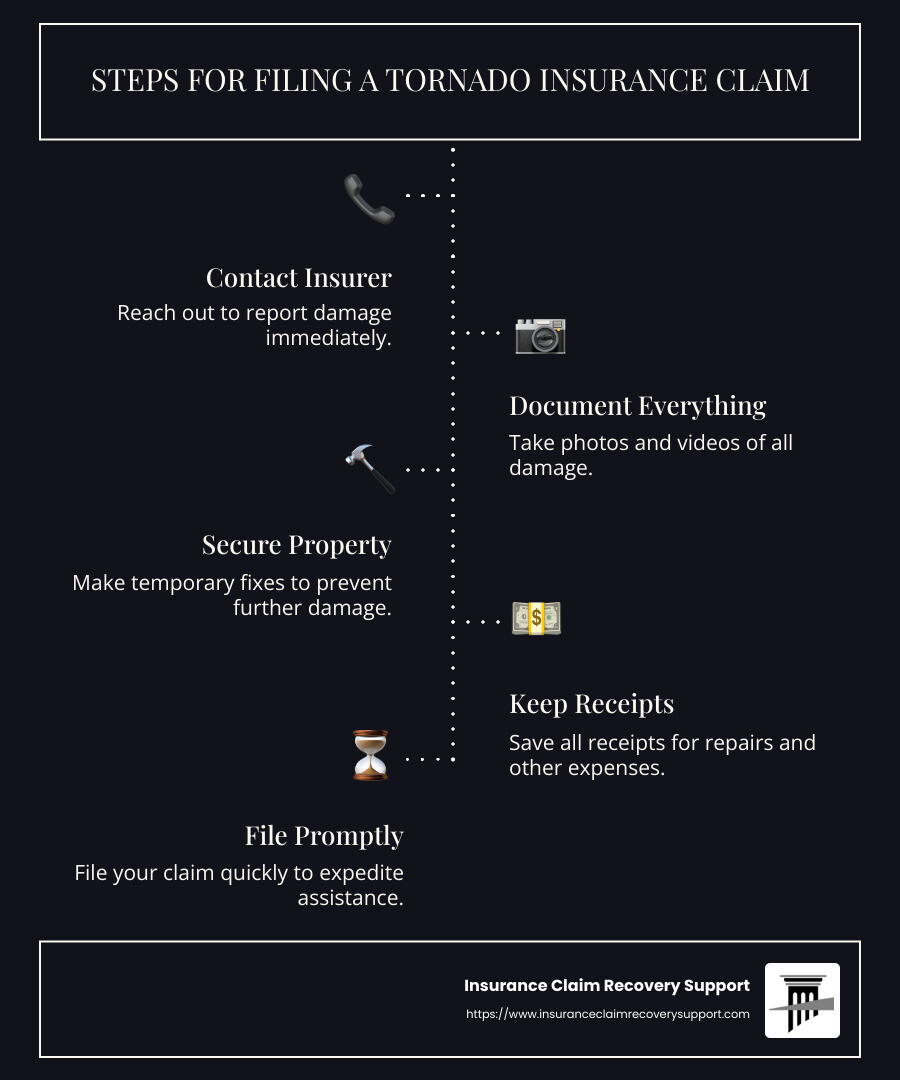

When disaster strikes, filing a tornado insurance claim becomes a priority for policyholders seeking to recover from the devastation. Here’s what you need to know right away:

- Contact Your Insurer: Reach out to your insurance company immediately to report damage.

- Document Everything: Take photos and videos of all damage before beginning any cleanup.

- Secure Your Property: Make temporary fixes to prevent further damage.

- Keep Receipts: Save all receipts for repairs and expenses like lodging and meals.

- File Promptly: The sooner you file, the quicker you’ll receive assistance.

Tornado damage can ravage homes, businesses, and communities, leaving policyholders facing the daunting task of recovery. Insurance companies can act as financial lifelines in these times, but navigating the claims process effectively is key to a successful settlement.

As Scott Friedson, a seasoned public adjuster, I’ve assisted numerous clients in successfully filing a tornado insurance claim. With a track record of maximizing settlements and correcting unfair denials, I bring a wealth of expertise to those enduring the aftermath of these natural disasters. Let’s explore how you can confidently manage your claim.

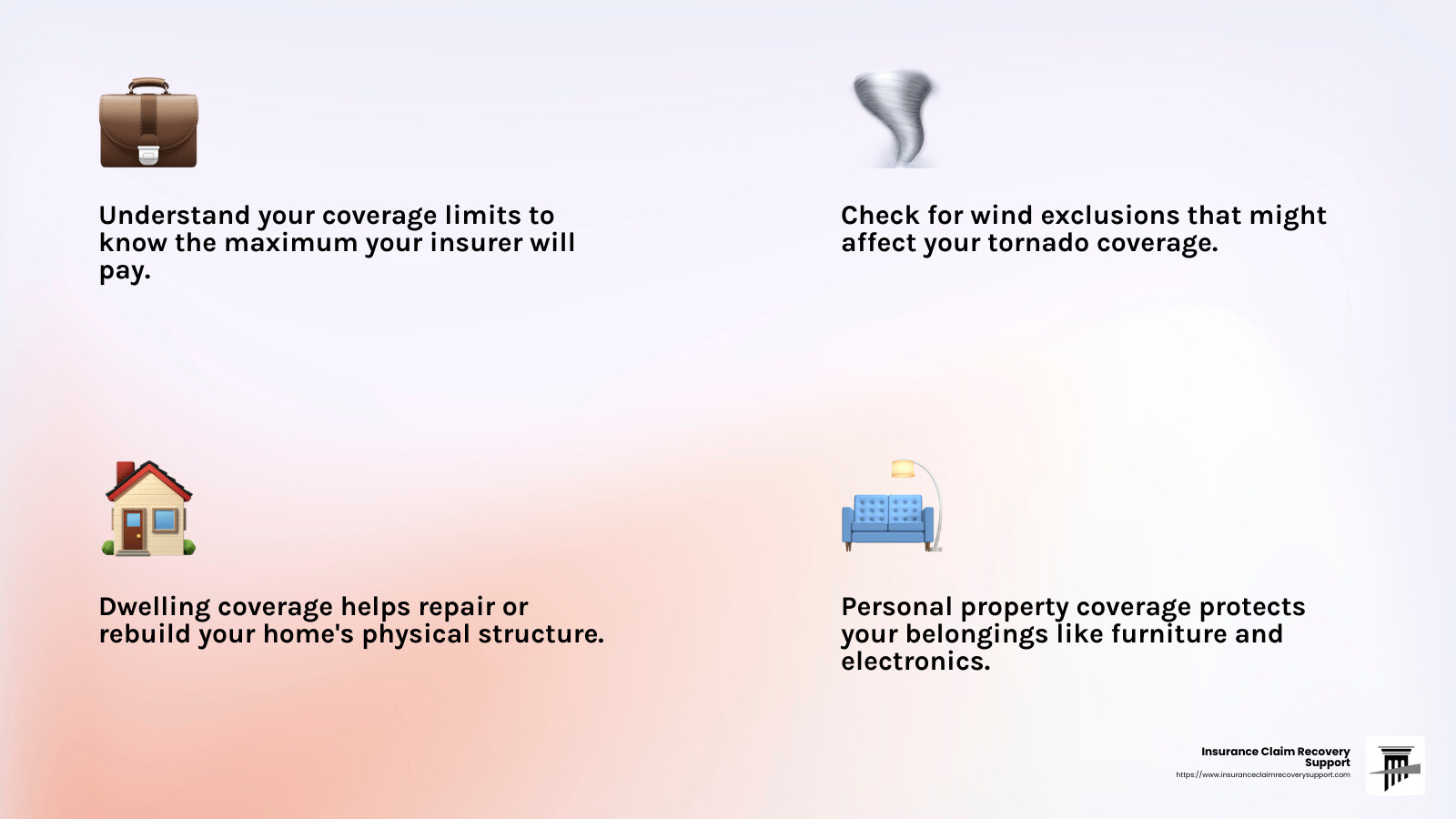

Understanding Your Policy

Before you start filing a tornado insurance claim, it’s crucial to understand your insurance policy. Knowing your coverage limits, wind exclusions, and the specifics of dwelling and personal property coverage can make a big difference in your recovery process.

Coverage Limits

Coverage limits are the maximum amounts your insurer will pay for a covered loss. For example, if your dwelling coverage limit is $250,000 and the tornado causes $300,000 in damage, you’ll need to cover the remaining $50,000 out of pocket. It’s like being at an all-you-can-eat buffet with a plate size limit!

Wind Exclusions

Some policies have wind exclusions, which means they won’t cover damage caused by windstorms, including tornadoes. If you live in a tornado-prone area, check your policy to ensure wind damage is covered. If not, you might need separate windstorm insurance.

Dwelling Coverage

Dwelling coverage, also known as Coverage A, helps pay for repairs or rebuilding the physical structure of your home if it’s damaged by a tornado. This includes attached structures like garages or decks. Make sure you know your dwelling coverage limit to avoid surprises when filing a tornado insurance claim.

Personal Property Coverage

Personal property coverage, or Coverage C, protects your belongings like furniture, clothing, and electronics. If a tornado damages these items, this coverage helps replace them. However, some items might have specific sublimits, so check your policy details.

Understanding these elements of your policy will empower you to steer the claims process effectively. Next, we’ll dive into the steps for documenting the damage and contacting your insurance provider.

Filing a Tornado Insurance Claim

When it comes to filing a tornado insurance claim, how you document and report your damages can significantly impact the outcome. Let’s break down the steps to ensure you’re well-prepared.

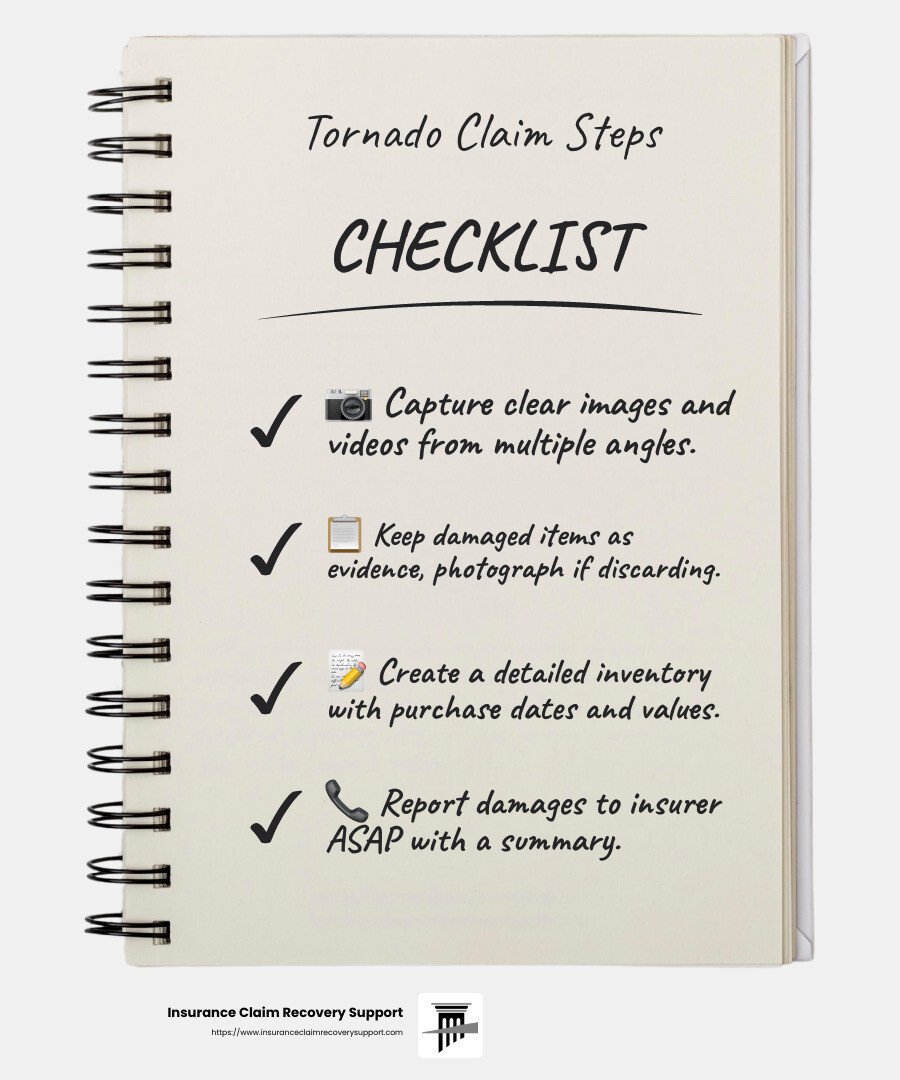

Documenting the Damage

As soon as it’s safe, start documenting the damage. This is a crucial first step in the claims process.

-

Photos and Videos: Use your smartphone or camera to capture clear images and videos of all affected areas. Take shots from multiple angles to provide a comprehensive view of the damage. Focus on both exterior issues, like roof and window damage, and interior problems, such as water stains and broken furniture.

-

Tangible Evidence: Keep any damaged items, like broken shutters or furniture, as evidence. If you must discard anything for safety reasons, make sure to photograph it first.

-

Home Inventory: Create a detailed list of all damaged or destroyed items. Include descriptions, purchase dates, and estimated values. If you have receipts or proof of purchase, attach them to your inventory. This will help substantiate your claim and ensure you’re compensated fairly.

Contacting Your Insurance Provider

Once you have your documentation ready, it’s time to contact your insurance company.

-

Report Damages: Call your insurer as soon as possible to report the damages. Provide a summary of the damage and your policy details. This initiates the claim process and alerts them to your situation.

-

Initiate Claim: Your insurer will guide you through the next steps, including filling out claim forms. Make sure to complete and return these forms promptly to avoid delays.

-

Adjuster Inspection: An adjuster will likely visit your property to assess the damage. Be prepared to show them all documented evidence and your home inventory. This visit is crucial for determining how much the insurance company will pay for your loss.

Pro Tip: Keep records of all interactions with your insurer, including names, dates, and key points discussed. This helps maintain a clear communication trail.

By carefully documenting the damage and promptly contacting your insurance provider, you lay a strong foundation for your claim. Next, we’ll explore tips for maximizing your claim and ensuring you get the compensation you deserve.

Tips for Maximizing Your Claim

Filing a tornado insurance claim is just the beginning. To get the most out of your claim, you need to take proactive steps and work smartly with contractors. Here’s how:

Prevent Further Damage

After a tornado, it’s crucial to prevent further damage to your property.

-

Temporary Repairs: Cover broken windows with plastic or board up holes in your roof. These simple actions can stop further damage from rain or wind. But remember, these are temporary fixes. Don’t start permanent repairs until your insurance company gives the green light.

-

Emergency Expenses: Keep receipts for any temporary repairs or emergency expenses, like hotel stays or meals if your home is uninhabitable. These might be reimbursed under your policy’s additional living expenses coverage.

Working with Contractors

Choosing the right contractor can make a big difference in your repair process.

-

Licensed Contractors: Always hire licensed and insured contractors. This ensures they have the right skills and are accountable for their work.

-

Multiple Quotes: Get quotes from at least three contractors. This not only helps you find a fair price but also gives you leverage when negotiating with your insurance company.

-

Avoid Scams: Be cautious of contractors who show up uninvited after a storm. Some might try to scam you. Verify their credentials and check for reviews online. Never pay cash upfront.

Proactive Steps

Taking proactive steps can help you in the long run.

-

Document Everything: Continue to document any further damage or repairs. This ongoing record can be vital if disputes arise with your insurer.

-

Stay in Touch: Maintain regular communication with your insurance adjuster. Provide any additional information they request promptly. This keeps your claim moving smoothly.

By following these tips and working closely with reputable contractors, you can maximize your claim and ensure you receive the compensation you deserve.

Next, we’ll address some frequently asked questions about tornado insurance claims to clear up any lingering uncertainties you might have.

Frequently Asked Questions about Tornado Insurance Claims

What is Covered by Homeowners Insurance?

Dwelling Coverage: This covers the physical structure of your home. If a tornado damages or destroys your house, dwelling coverage helps pay for repairs or rebuilding. Make sure you know your coverage limits to avoid surprises.

Personal Property Coverage: Your belongings, like furniture and electronics, are also covered. If they’re damaged by a tornado, this coverage helps replace them. Some items have sublimits, meaning there’s a cap on how much you can claim for certain types of belongings.

Loss of Use Coverage: If your home is uninhabitable after a tornado, this coverage helps with additional living expenses. It can cover the cost of temporary housing, meals, and other essentials while your home is being repaired.

How Long Do I Have to File a Claim?

Claim Deadlines: Most insurance companies require you to file a claim within a certain period after the tornado. This timeframe can vary, so check your policy for specifics. Filing promptly helps ensure a smoother process.

Immediate Reporting: Report damages to your insurer as soon as possible. Quick action can speed up the claims process and help you get back on your feet faster.

What if My Insurance Doesn’t Cover Everything?

FEMA Assistance: If your insurance falls short, you might qualify for help from FEMA. They offer grants and assistance programs for disaster recovery. Check their website for more information.

Additional Coverage: Consider purchasing extra coverage if you live in a tornado-prone area. Options like flood insurance or windstorm insurance can fill gaps in your standard policy, offering more comprehensive protection.

By understanding your coverage and acting quickly, you can steer the claims process more effectively. Up next, we’ll dive deeper into how to ensure your claim is as successful as possible.

Conclusion

Navigating the aftermath of a tornado can be overwhelming, but Insurance Claim Recovery Support is here to help. We specialize in advocating for policyholders, ensuring you receive the maximum settlement you deserve. Our team is dedicated to making sure your claim is not undervalued or unfairly denied.

Policyholder Advocacy is at the heart of what we do. Tornadoes can leave you feeling powerless, but with our expertise, you don’t have to face the insurance maze alone. We stand by you, working tirelessly to ensure your claim is handled with the care and attention it deserves.

Securing a maximum settlement is crucial for your recovery. Tornado damage can be extensive, affecting everything from your roof to your personal belongings. We understand the intricacies of insurance policies and are skilled at documenting and advocating for the fullest possible compensation.

Consider the case of a business owner in Houston who faced $100,000 worth of tornado damage. By carefully documenting every aspect of the damage and negotiating with the insurer, we helped secure a settlement that fully covered their repair costs, minus the deductible.

Why Choose Us?

- Expertise: We specialize in Texas weather-related claims with a keen focus on tornadoes.

- Commitment: Our goal is to ensure you receive a fair and prompt settlement.

- Support: We stand with property owners in their journey to recovery, providing exceptional service and uncompromising support.

For more information on how we can assist you with your insurance claim, visit our Tornado Damage Assessment page. Let us help you steer the path to recovery.