Why Your Industrial Property Insurance Claim Demands Immediate, Strategic Action

An Industrial Property Insurance Claim is the process of seeking compensation from your insurer for damage to manufacturing facilities, warehouses, or distribution centers. It’s far more complex than most property owners realize, and the stakes are incredibly high.

Quick Answer: Managing Your Industrial Property Insurance Claim

- Act Fast: Within 24-48 hours, secure your property, document all damage before cleanup, and notify your insurer.

- Know the Stakes: Business interruption losses often exceed direct property damage, sometimes by 300-400%.

- Document Everything: Hidden damages like moisture, contamination, and electrical issues can eclipse visible losses.

- Understand Timelines: In Texas, insurers must acknowledge your claim within 15 days and pay within 5 business days after acceptance.

- Get Expert Help: For claims over $100,000, a public adjuster can significantly increase your settlement.

When disaster strikes your industrial facility, the visible damage is just the beginning. The financial impact of downtime and hidden damage often eclipses physical repair costs. Insurance companies know this and deploy experienced adjusters to minimize payouts on high-value industrial claims, using depreciation and business interruption formulas that protect their bottom line, not yours.

Industrial property claims are unique in three critical ways:

- Specialized Machinery: Requires expert valuation and assessment.

- Massive Business Interruption: Every day of downtime can cost tens of thousands of dollars.

- Complex Regulations: Environmental and zoning rules complicate repairs and rebuilding.

From severe thunderstorms in the Dallas-Fort Worth area to fires and equipment failures statewide, Texas industrial properties face constant threats. Each event presents unique documentation and valuation challenges that can make or break your claim.

I’m Scott Friedson, a Multi-State Licensed Public Adjuster and CEO of Insurance Claim Recovery Support. With over 15 years of experience settling hundreds of millions in industrial claims, I’ll guide you through the process to help you avoid the pitfalls that cost business owners millions every year.

To better understand how commercial insurance works at a high level, you can also review independent resources like the Insurance Institute for Business & Home Safety or the overview of property insurance on Wikipedia.

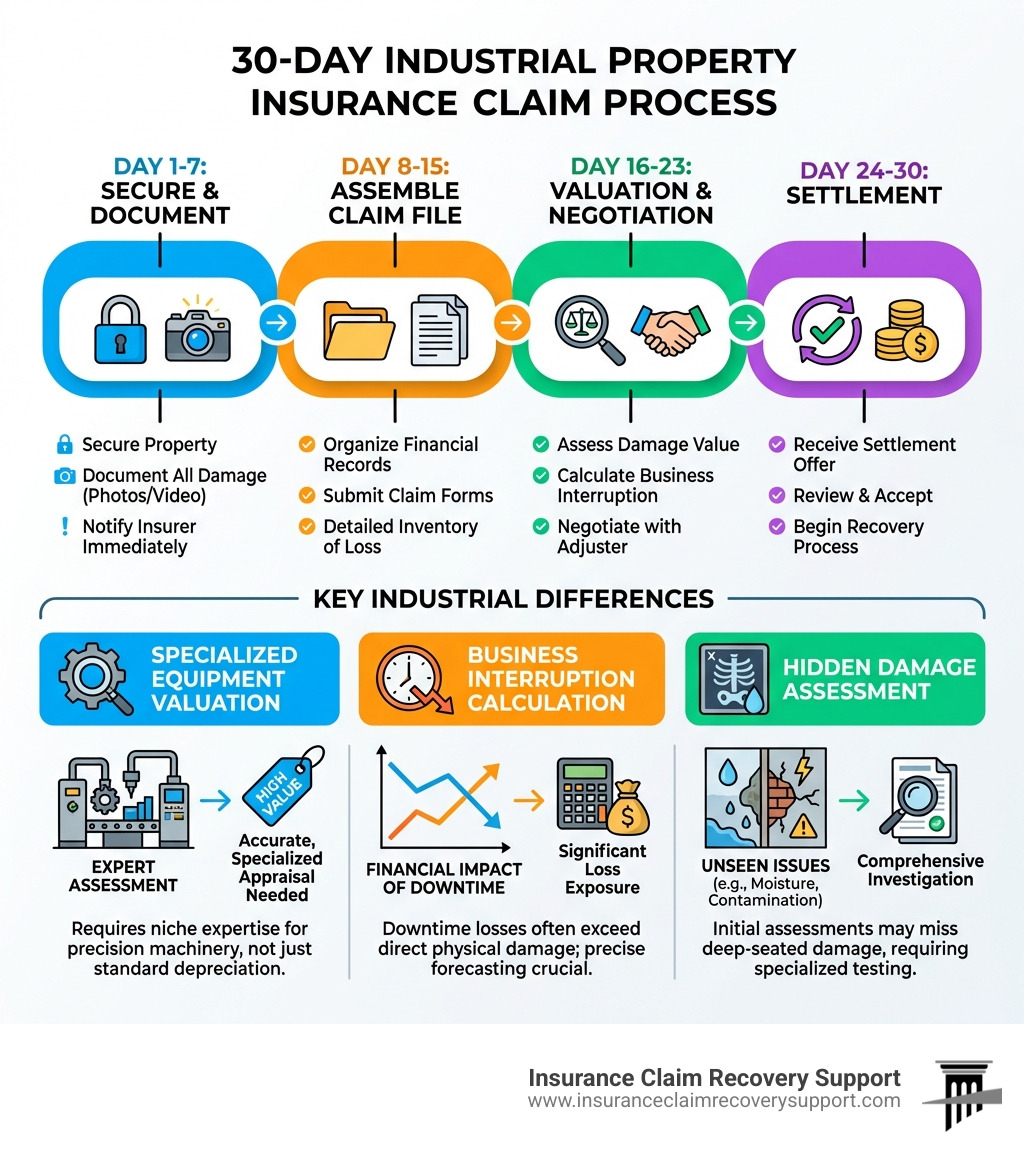

The Step-by-Step Guide to Your Industrial Property Insurance Claim

A structured approach can significantly improve your chances of a fair settlement. Follow this action plan from the moment you find damage.

Phase 1: Immediate Actions After a Loss (First 72 Hours)

What you do immediately after a disaster is critical. Safety is always the first priority.

- Secure the Property: Prevent further damage by boarding up windows, tarping roofs, or shutting off utilities. After a Fort Worth storm, for example, a tarp can prevent millions in additional water damage. Your policy requires you to mitigate further loss.

- Notify Your Insurer: Contact your insurance carrier immediately. In Texas, insurers must acknowledge your claim within 15 days.

- Document Before Cleanup: This is crucial. Take extensive photos and videos of all damage, from wide shots to close-ups of equipment and inventory. An Austin manager noted that clients with thorough initial documentation after the 2021 freeze saw settlements 40% higher on average.

- Make Emergency Repairs: If repairs are needed to prevent more damage or resume operations, proceed cautiously. Save damaged parts for the adjuster and keep all receipts. If a pipe bursts in a San Antonio warehouse, fix it but keep the corroded section as evidence.

Phase 2: Mastering Documentation

Comprehensive documentation is the foundation of a successful Industrial Property Insurance Claim.

Crucial Documents:

- Proof of Loss: A sworn statement detailing your loss, typically required within 60 days of the insurer’s request in Texas.

- Detailed Inventories: List all damaged equipment, materials, and building components with make, model, serial numbers, and costs. A San Antonio client’s settlement grew by $1.2 million after a thorough inventory identified 37% more damaged items than the insurer’s initial count.

- Financial Records: Gather 2-3 years of financial statements, production records, and sales forecasts to substantiate business interruption claims.

- Expert Reports: For complex claims, use engineering reports for structural damage, equipment evaluations for machinery, and environmental testing for contamination. A Georgetown facility’s equipment settlement jumped over 200% after providing detailed maintenance and operational records.

Documenting Hidden Damage:

Go beyond visible damage. Use thermal imaging to find trapped moisture in roofs—a technique that reversed a denial and secured a $1.7 million settlement for a Waco facility. Employ engineers to find hidden structural issues and contamination analysis for microscopic particles.

Valuing Specialized Machinery:

Insurers often push for Actual Cash Value (ACV), which is replacement cost minus depreciation. We fight for Replacement Cost Value (RCV) or Functional Replacement Cost for obsolete items to ensure you get what you need to resume operations.

For More info about commercial property claims, we encourage you to visit our dedicated resource page.

Phase 3: Negotiation and Settlement

This is where you engage with your insurer to reach a fair agreement.

Common Devaluation Tactics:

Be aware of insurer tactics like applying aggressive depreciation, undervaluing business interruption, excluding hidden damages, and disputing the cause of loss. A Houston chemical plant’s business interruption claim was initially valued at $1.2 million; after our analysis, it settled for $4.7 million.

Negotiation Best Practices:

- Be Prepared: Present a complete, evidence-backed claim package.

- Know Your Policy: Understand your coverage, limits, and deductibles.

- Communicate in Writing: Keep a detailed record of all interactions.

- Support Your Numbers: Back up your valuations with expert opinions and data.

- Be Patient but Firm: Don’t accept a lowball offer out of frustration.

Texas Claim Timeline:

Texas law requires insurers to act promptly:

- 15 Business Days: To acknowledge your claim.

- 15 Business Days: To accept or reject the claim after receiving all documentation.

- 5 Business Days: To issue payment after acceptance.

Securing Advance Payments:

Cash flow is critical. We often help clients secure advance payments for immediate needs. A Round Rock manufacturer received a $750,000 advance, allowing them to start repairs while we negotiated the full $3.2 million settlement.

For additional Guidance on disaster recovery from FEMA, we recommend exploring their resources.

FAQ: Avoiding Pitfalls and Maximizing Your Settlement

When should I hire a public adjuster for an industrial property claim?

The decision to hire a public adjuster can be the most important one you make for your claim’s outcome.

| Feature | Insurer’s Adjuster | Public Adjuster |

|---|---|---|

| Who They Represent | The Insurance Company | The Policyholder (YOU) |

| Primary Goal | Minimize the insurance company’s payout | Maximize your settlement for a full recovery |

| Loyalty | To the insurance company | To you, the policyholder |

| Expertise | Follows company protocols | Specialized in policyholder advocacy & claims strategy |

| Fee Structure | Paid by the insurer | Percentage of the settlement (no recovery, no fee) |

Consider hiring a public adjuster if:

- Your estimated damages exceed $100,000.

- The claim involves specialized machinery, significant business interruption, or environmental issues.

- You’ve received a low offer or a denial.

- You lack the time or expertise to manage a complex claim.

Avoiding Litigation: A key advantage of using a public adjuster is avoiding lengthy and expensive lawsuits. We specialize in resolving claims with a 90% success rate without litigation. By presenting a carefully documented claim, we compel insurers to settle fairly, saving you time, money, and stress. For example, a San Antonio client’s fire damage claim settlement increased by over 400% after our intervention, avoiding a protracted legal battle.

Benefits of Early Engagement: Hiring a public adjuster in the first week allows us to guide documentation, prevent costly mistakes, and control the claim’s narrative from the start.

How can I effectively document business interruption?

Business interruption (BI) losses often dwarf property damage. As a Dallas client said, “The machine isn’t just broken—it’s costing us $30,000 every day it sits idle.” To maximize your Industrial Property Insurance Claim, document the following:

- Lost Profits: Use 2-3 years of financial records (P&L statements, sales forecasts) to project the income you lost.

- Continuing Expenses: Track ongoing costs like payroll for key staff, rent, and utilities.

- Extra Expenses: Keep receipts for costs incurred to minimize downtime, like renting temporary space or outsourcing production.

- Extended Period of Indemnity: Your policy may cover losses until your business fully returns to pre-loss operational levels, not just when repairs are done. This can add 30-60% to a claim’s value.

How can I prevent future losses and lower premiums?

Use your claim as an opportunity to “future-proof” your facility.

Risk Mitigation Strategies:

- Structural Upgrades: Invest in impact-resistant roofing. A Dallas client’s $175k roof upgrade prevented an estimated $1.2M in damage during a later storm.

- System Protection: Install fire suppression systems, backup generators, and surge protectors. A $30k investment in backup power saved an Austin manufacturer over $400k in losses.

- Pre-Loss Planning: Create a digital inventory of all assets with photos, receipts, and maintenance records. A Lakeway client used a cost segregation study during their rebuild to create over $230,000 in first-year tax benefits.

After making improvements, document them and present them to your insurer at renewal. A San Angelo client’s upgrades led to a 23% reduction in their annual premium.

At Insurance Claim Recovery Support, we help you steer your industrial property insurance claim from start to finish. Our expertise ensures you receive the maximum recovery you’re entitled to.

Get a free claim review today—it might be the most valuable 30 minutes you invest in your recovery.