The latest2024 U.S. Property Claims Satisfaction Study from J.D. Power delivers a clear warning to homeowners and commercial property owners alike: customer satisfaction with insurance claims is at its lowest point in seven years. J.D. Power

The reason? A perfect storm of increasing catastrophic weather events, prolonged repair cycles, and rising premiums is testing the limits of both insurers and policyholders. But amid the chaos, there’s one solution that continues to prove its value: working with a knowledgeable, experienced public adjuster like Insurance Claim Recovery Support (ICRS).

Key Findings:

Record-Breaking Catastrophic Events: In 2023, the U.S. experienced 28 catastrophic weather events, each causing over $1 billion in damages, totaling $92.9 billion nationwide. J.D. Power

Extended Repair Cycle Times: The average claims cycle time has increased to 23.9 days, over six days longer than reported in the 2022 study. J.D. Power

Customer Satisfaction Decline: These challenges have led to a sharp decrease in customer satisfaction with the property claims process. J.D. Power

Delays, premium hikes, and policy complexity have left policyholders confused, frustrated, and often underpaid.

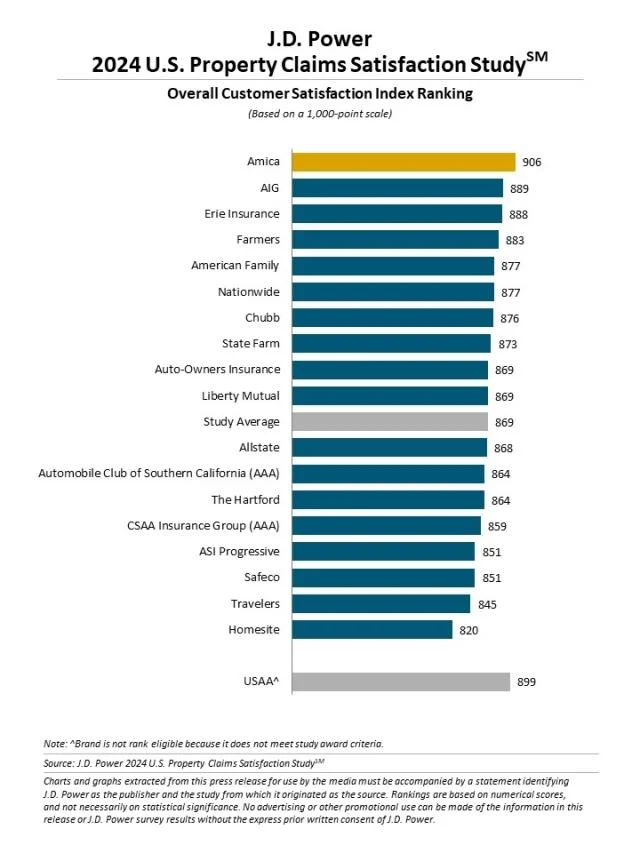

Top Performers:

Amica ranks highest in property insurance claims experience with a score of 906.J.D. Power+3J.D. Power+3J.D. Power+3

AIG (889) and Erie Insurance (888) follow in second and third places, respectively. J.D. Power+7J.D. Power+7J.D. Power+7

🔍 Why This Matters to Property Owners

For commercial and multifamily property owners dealing with significant losses due to fire, hail, hurricane, flood, or tornado, these findings are more than just statistics—they reflect real-world struggles to get claims handled fairly and promptly.

Many owners are now entering the claims process already frustrated from recent premium hikes, only to face slow communication, vague policy explanations, and low settlement offers.

This is where ICRS steps in.

🛠️ How ICRS Solves the Claims Satisfaction Problem

At Insurance Claim Recovery Support, we advocate exclusively for you, the policyholder—not the insurance company.

Here’s how we help our clients overcome the issues highlighted in the J.D. Power study:

✅ 1. Faster, More Thorough Claim Management

ICRS knows how to navigate insurer delays and push for action. Our team works to shorten the claim timeline, cutting through red tape and ensuring your documentation is airtight from day one.

✅ 2. Clear Policy Guidance

Confused by exclusions, endorsements, or confusing language? We break down your policy and explain what’s covered, what’s not, and how to avoid claim denials or underpayments.

✅ 3. Maximum Settlement Support

Insurers are paying out less—but that doesn’t mean you have to accept less. ICRS meticulously documents all damage and loss, ensuring nothing is left off the table. We’ve settled 90% of large-loss claims without litigation or appraisal.

✅ 4. No Recovery, No Fee

If you don’t get paid, we don’t get paid. That’s our promise. We align our interests with yours—something you’ll never get from an insurance company’s adjuster.

The increase in severe weather events and extended repair times have strained the property insurance claims process, leading to decreased customer satisfaction. Insurers are challenged to manage expectations and proactively communicate during longer claim periods, as customers tend to have more questions when experiencing delays. J.D. Power

Recommendations for Policyholders:

Understand Your Policy: Review your coverage details to know what’s included and excluded.

Document Everything: Keep detailed records of your property and any damages.

Communicate Proactively: Stay in regular contact with your insurer to manage expectations.

By staying informed and proactive, homeowners can better navigate the challenges highlighted in the 2024 study.

👇 The Bottom Line

The 2024 J.D. Power study confirms what many already suspect: the claims system is under strain, and policyholders are paying the price. But you don’t have to go it alone.

Whether you’re dealing with a current claim or planning ahead, working with ICRS gives you peace of mind, expert guidance, and the advocacy you need to recover fully and fairly.

🧾 Start with a claim review

👉 www.insuranceclaimrecoverysupport.com