Why Understanding Building Insurance Claims Can Save Your Business Thousands

Building insurance claims can be one of the most critical processes you’ll navigate as a commercial or multifamily property owner or manager. Whether you’re dealing with fire damage at an office, storm destruction on an apartment complex, or hurricane devastation to a retail center, managing your claim properly can mean the difference between a full recovery and a settlement that leaves you financially exposed.

Quick Answer: What You Need to Know About Building Insurance Claims

- Report immediately – Notify your insurer as soon as damage occurs to avoid claim denial.

- Document everything – Take photos, videos, and keep all receipts for emergency repairs.

- Understand your coverage – Know the difference between Replacement Cost Value (RCV) and Actual Cash Value (ACV).

- Secure your property – Make temporary repairs to prevent further damage (required by most policies).

- Prepare for the adjuster – Gather contractor bids, damage inventories, and policy documents before their visit.

- Know your rights – You can hire your own public adjuster and choose your own contractors.

The stakes are high. Water damage, fires, and severe weather are leading causes of costly commercial property claims. For Texas property owners and managers, events like hurricanes, tornadoes, and freezes create billions in insured losses annually. Yet, many find themselves in disputes over settlement amounts or accepting lowball offers because they don’t understand the process.

The insurance company’s adjuster works for the insurer—not for you. Their goal is to settle claims cost-effectively for their employer. Policyholders often make critical mistakes like beginning major repairs before approval or assuming they must use the insurer’s preferred contractors. These missteps can result in denied claims or reduced settlements.

This guide walks you through the building insurance claims process for commercial properties, multifamily complexes, and institutional buildings. You’ll learn how to protect your interests and maximize your recovery—and how a public adjuster can help you avoid unnecessary litigation.

I’m Scott Friedson, CEO of Insurance Claim Recovery Support. For over 15 years, I’ve successfully negotiated hundreds of millions of dollars in building insurance claims for property owners. My firm has increased claim recoveries by 30% to over 3,800% by overturning wrongful denials and negotiating fair settlements—helping property owners avoid the time and cost of insurance litigation.

The Commercial Property Owner and Manager’s Playbook for Building Insurance Claims

Your commercial property is a major asset, and your insurance policy is its safety net. Whether you own or manage commercial or multifamily properties, building insurance protects the physical structure and its permanent fixtureslike plumbing, electrical, and HVAC systemsfrom unforeseen events, or “perils.”

In Texas, these perils are common. Fire damage can be catastrophic. Severe weather like hurricane and tornado damage causes widespread destruction from Houston to Fort Worth. Freeze damage from burst pipes has caused massive water damage in cities like Austin and San Antonio. It’s also vital to understand that flood damage from external sources is typically excluded unless you have separate coverage, whereas water damage from internal sources like burst pipes is usually covered. Wind-driven rain and straight-line winds also frequently damage roofs and building envelopes across North Texas.

Prevention and mitigation are often policy requirements. When damage does occur, your actions in the first few hours are critical to the outcome of your building insurance claims.

Step 1: Immediate Actions After Finding Damage

What you do immediately after finding damage will directly impact your claim’s outcome.

- Safety First: If there’s a fire or gas leak, evacuate everyone and call 911. Secure any structurally unstable areas and keep people out.

- Secure Your Property: You have a contractual obligation to prevent further damage. Tarp damaged roofs, board up broken windows, and start water extraction to prevent mold, which can grow within 24-48 hours. This applies whether you have water damage in an Austin apartment complex or fire damage in a Dallas office.

- Document Everything: Before major cleanup, take extensive photos and videos of all damaged areas. A narrated video walkthrough can be powerful evidence. Keep a detailed log of all communications and actions.

- Notify Your Insurer Promptly: Call your insurance company as soon as it’s safe. Have your policy number ready, describe the damage, and get a claim number. Waiting can jeopardize your claim.

- Make Emergency Repairs Only: Repairs should be temporary and focused solely on preventing more damage. Do not start permanent renovations before the adjuster’s inspection. Keep every single receipt for these temporary fixes.

Step 2: Assembling Your Proof of Loss and Understanding Key Terms

This phase is about building an airtight case for the full extent of your loss.

Your insurer will likely request a formal Proof of Loss, a sworn statement detailing your claim. Be meticulous and accurate. Create a detailed inventory of all damaged property, from structural components to equipment, and get at least two detailed, line-item repair estimates from reputable contractors.

If your business can’t operate, Business Interruption coverage may cover lost income and ongoing expenses. For uninhabitable multifamily units, Additional Living Expenses (ALE) or Loss of Use coverage can cover tenants’ temporary housing costs.

Understanding these key terms is crucial for negotiation:

- Replacement Cost Value (RCV) vs. Actual Cash Value (ACV): RCV covers replacement with new, similar materials. ACV is replacement cost minus depreciation. Most commercial policies are RCV, which is more favorable.

- Depreciation: This is the reduction in value due to age and wear. With an RCV policy, you typically receive the ACV upfront. The withheld depreciation (called recoverable depreciation) is paid after you complete repairs and provide receipts.

- Policy Limits and Deductibles: Policy limits are the maximum payout. Deductibles are your out-of-pocket share. For wind and hail claims in Texas, deductibles are often 1% to 5% of the property’s value, which can be a substantial amount.

Here’s how RCV and ACV compare for a commercial roof:

| Feature | Replacement Cost Value (RCV) | Actual Cash Value (ACV) |

|---|---|---|

| Payout Basis | Cost to replace with new, similar materials | Replacement cost minus depreciation for age and wear |

| Initial Payment | Often ACV upfront, with recoverable depreciation paid after repairs | ACV only (current market value) |

| Depreciation | Not deducted from final payment (paid separately after repairs) | Deducted immediately from settlement |

| Property Age Impact | Minimal impact on final payout (you get new for old) | Significant impact; older items result in much lower payouts |

| Example (Roof) | $100,000 to replace a 15-year-old roof (full replacement cost) | $100,000 replacement cost $60,000 depreciation = $40,000 payout |

Step 3: Navigating the Adjuster Visit and the Settlement Process

Your interaction with the insurance adjuster is a pivotal moment in your claim.

There are three types of adjusters: company adjusters and independent adjusters both work for the insurance company. A public adjuster, like those at Insurance Claim Recovery Support, works exclusively for you, the policyholder, to maximize your settlement.

Prepare for the adjuster’s meeting. Have all your documentation ready: photos, videos, contractor bids, and emergency repair receipts. Be present for the walk-through and point out all damage. The adjuster will create their own scope of loss, which often differs from your contractor’s bids. Compare them line by line.

The claim timeline can range from weeks to over a year for complex commercial claims. When the settlement offer arrives, don’t assume it’s finalit’s a starting point for negotiation. If your property has a mortgage, the settlement check will likely be co-payable to you and your lender, who will release funds in stages as repairs are completed. This process can feel overwhelming, but having a public adjuster levels the playing field and ensures you’re not pressured into an unfair settlementoften avoiding unnecessary litigation.

Overcoming Claim Problems and Finalizing Your Recovery

Even with careful preparation, it’s common to encounter challenges with building insurance claims. You might face a lowball offer, unreasonable delays, or an outright denial. An insurer might dispute repair costs, blame “wear and tear” for storm damage in Waco, or apply excessive depreciation to a claim in San Angelo. This is where knowing your rights and having a strong advocate is critical.

Fact vs. Myth: Debunking Common Misconceptions in Building Insurance Claims

Misinformation can cost you thousands. Let’s debunk a few common myths.

-

Myth: The first offer is final.

Fact: The initial offer is a starting point for negotiation. Policyholders who negotiate or hire a public adjuster often achieve significantly higher settlements, sometimes 3 to 4 times the initial offer. -

Myth: You must use the insurer’s recommended contractor.

Fact: You have the absolute right to choose your own licensed contractor. This gives you control over the quality and timeline of your repairs. -

Myth: Filing a claim always drastically raises premiums.

Fact: While a claim can affect future premiums, it’s not guaranteed. For major property damage, the financial recovery from a legitimate claim far outweighs potential premium adjustments.

When You Disagree: Public Adjuster vs. Insurance Claim Lawsuit for a Fair Settlement

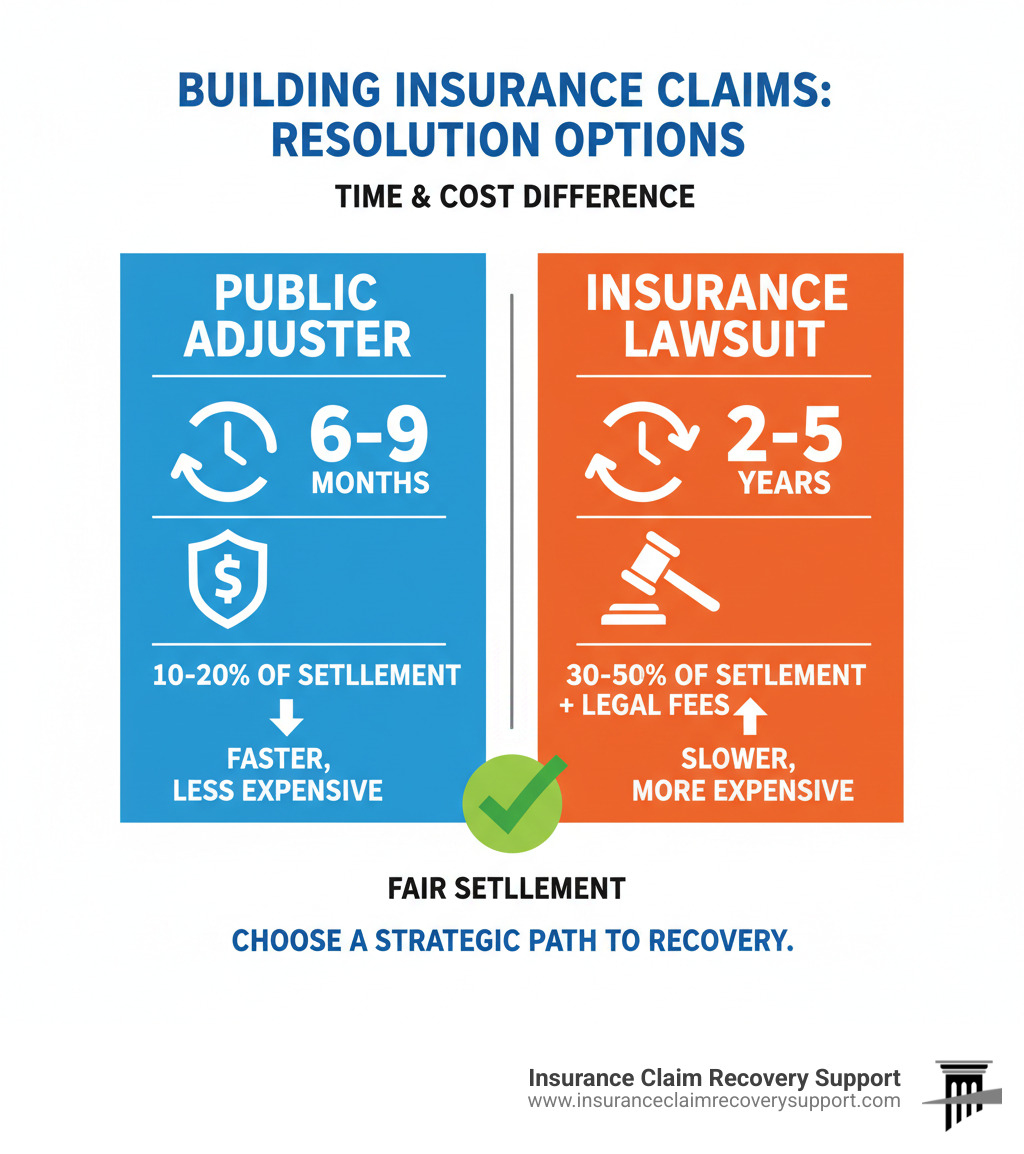

When you and your insurer can’t agree on your building insurance claims, you have options.

The public adjuster approach is often the smartest first move. As public adjusters, we work exclusively for you. Our role is to provide expert documentation of your loss, handle all skilled negotiation with the insurer, and maximize your settlement. Crucially, this approach helps you avoid unnecessary litigation. Our firm has a track record of increasing claim recoveries by 30% to over 3,800%, helping property owners get fair settlements without the time and cost of a lawsuit.

The insurance claim lawsuit route should be a last resort. It is an adversarial, time-consuming, and expensive process that can take years and cost six figures in legal fees, all while your recovery is on hold. The outcome is also uncertain. A public adjuster aims to secure a fair settlement efficiently. If a lawsuit becomes necessary, the case we’ve built provides a strong foundation for your attorney.

Your Rights as a Policyholder and Finalizing Your Building Insurance Claims

As a policyholder, you have fundamental rights. These include the right to prompt communication, fair dealing from your insurer, and the right to choose your own contractor. You can learn more about your rights by visiting the Texas Department of Insurance: Know your rights as a Texas policyholder.

When finalizing your claim, remember recoverable depreciation. Your initial payment is often the Actual Cash Value (ACV). You must submit receipts for completed repairs to receive the remaining depreciation amount and get the full Replacement Cost Value (RCV).

At Insurance Claim Recovery Support, we are a public adjustment firm that exclusively represents policyholders in their building insurance claims. We specialize in commercial, multifamily, and institutional property damage claims across Texas cities like Austin, Dallas, Fort Worth, and Houston. Don’t steer the complex claims process alone. Let our expertise work for you to ensure you receive the maximum settlement you deserve.

Get professional help with your Tarrant County property damage claim