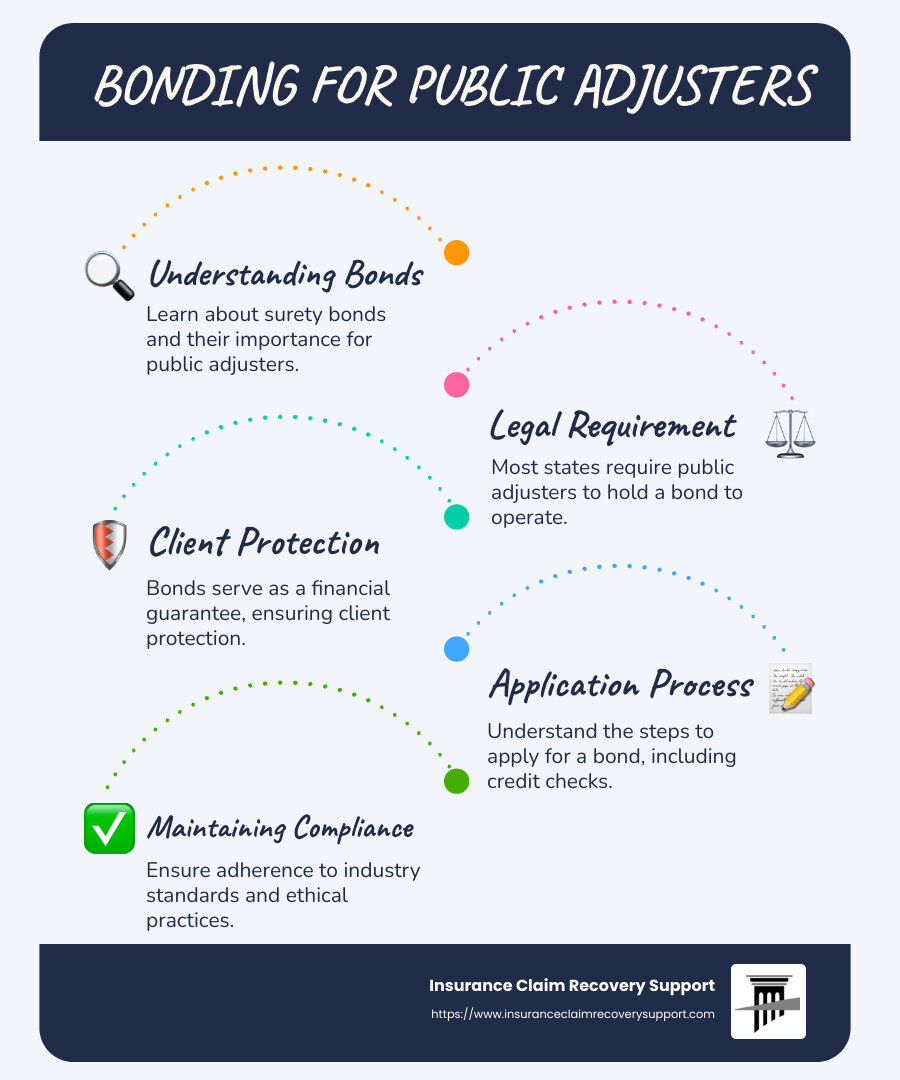

Bonding for public adjusters is essential for anyone entering the insurance claims field. It acts as a financial guarantee, ensuring that you, as a public adjuster, adhere to industry regulations and ethical standards. Here’s what you need to know right off the bat:

- Public adjusters need a bond to legally operate in most states.

- A public adjuster bond protects clients by ensuring compliance with legal and ethical standards.

- Bonds provide a safety net against potential errors or fraud, increasing client trust.

- The bond’s primary role is safeguarding the client’s interests during the claims process.

A public adjuster is a professional who works for policyholders to negotiate insurance claims, ensuring clients receive fair compensation. Obtaining and maintaining a bond is crucial, particularly as more states require public adjusters to be bonded as part of their licensing process. These bonds provide a layer of protection, serving as a safeguard against unethical practices or mishandling of claims.

I’m Scott Friedson, a multi-state licensed public adjuster and CEO of a leading large-loss public adjusting firm. With over 500 large loss claims successfully settled, I bring extensive expertise to this guide. Stay with me as we dig into the nuances of bonding for public adjusters, equipping you with the knowledge needed to steer this critical aspect of your career.

Understanding Public Adjuster Bonds

When stepping into public adjusting, understanding the concept of a surety bond is vital. At its core, a surety bond is a three-party agreement that provides financial protection to clients and ensures compliance with state regulations. Here’s how it works:

-

Principal: This is you, the public adjuster. You’re responsible for adhering to ethical and legal standards.

-

Obligee: Typically, this is the state agency that licenses public adjusters. They require the bond to protect the public.

-

Guarantor: The surety company that backs your bond, promising to pay claims if you fail to meet your obligations.

Why Are Public Adjuster Bonds Necessary?

Licensing Requirement: In 44 states, obtaining a public adjuster bond is a mandatory step in the licensing process. Without it, you can’t legally operate. This bond acts as a promise that you’ll follow the rules and regulations set forth by the state.

Financial Protection: Think of the bond as a safety net. It protects your clients if something goes wrong. If you fail to fulfill your duties ethically or legally, a claim can be made against your bond. This ensures that clients aren’t left in the lurch.

How Does a Public Adjuster Bond Work?

If a client believes you’ve acted unethically or mishandled their claim, they can file a claim against your bond. If the claim is valid, the surety company will compensate the client, up to the bond amount. However, you’ll be responsible for reimbursing the surety company, emphasizing the importance of maintaining high ethical standards.

Key Takeaways

- Surety bonds are a contract involving you, your state, and a surety company.

- They’re crucial for financial protection and are a licensing requirement in most states.

- A bond ensures that public adjusters operate within the bounds of the law, safeguarding client interests.

Understanding these fundamentals prepares you for the next step: acquiring your bond. Stay tuned as we explore how to obtain a public adjuster bond seamlessly.

Bonding for Public Adjusters: Key Considerations

When you’re ready to become a public adjuster, bonding for public adjusters is a critical step. Let’s break down the key considerations: bond amount, bond cost, and bond term.

Bond Amount

The bond amount is the maximum coverage provided by the bond. It varies from state to state. For instance, in Illinois, the bond amount is $50,000. This amount is not what you pay upfront but represents the financial coverage in case a claim is made against you. The bond assures clients that you have the backing to cover potential financial mishaps.

Bond Cost

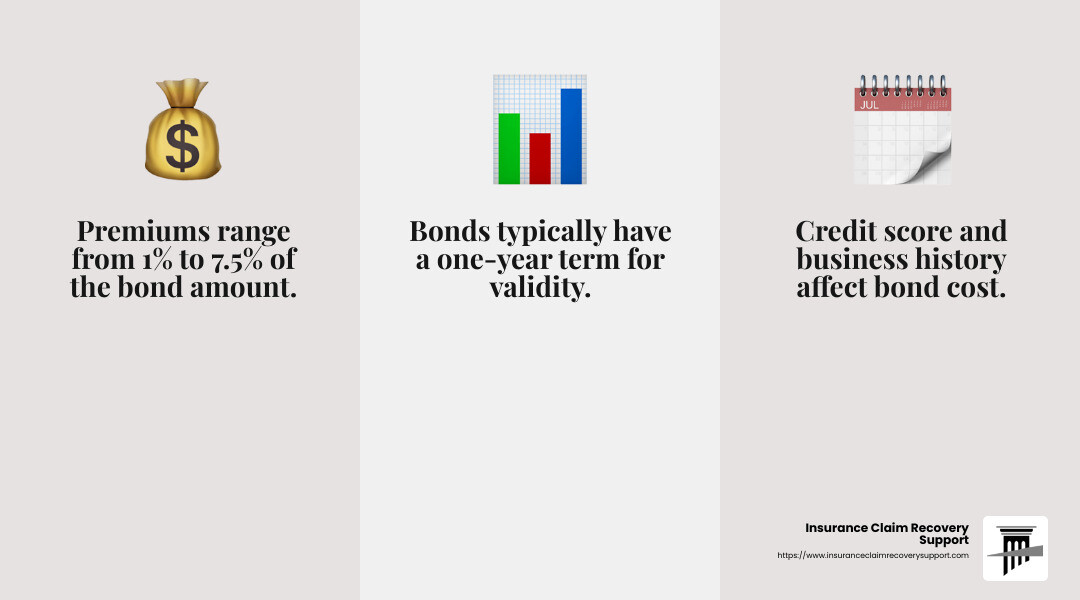

The cost of your bond, known as the premium, is a small percentage of the bond amount. Typically, it ranges from 1% to 7.5%. This means if your bond amount is $50,000, your cost might be between $500 and $3,750, depending on factors like your credit score and business history. For example, in Illinois, you can secure a $50,000 bond for a flat rate of $350 per year without underwriting.

Bond Term

The bond term refers to how long your bond remains valid. Most bonds are issued for a one-year term, but opting for longer terms can save you time and hassle. In Illinois, you can choose terms of one, two, or three years, with prices of $350, $613, and $875, respectively. Longer terms mean less frequent renewals, helping you focus on your work rather than paperwork.

Why Consider These Factors?

Understanding these elements ensures you’re well-prepared and compliant with state regulations. The right bond amount, cost, and term can provide peace of mind and financial security, allowing you to focus on helping your clients.

With these key considerations in mind, you’re ready to move on to the next step: how to obtain a public adjuster bond.

How to Obtain a Public Adjuster Bond

Now that you understand the key considerations for bonding for public adjusters, let’s dive into the process of obtaining one. Here’s a simple breakdown of the steps involved:

Application Process

To get started, you’ll need to fill out an application with a surety bond company. This application requires some basic information about you and your business. It’s similar to applying for a loan or insurance policy. You’ll need to provide details like your business name, address, and the bond amount required by your state.

Example: In Illinois, public adjusters must submit their bond forms to the Department of Insurance. Make sure your application is complete and accurate to avoid delays.

Credit Check

Once your application is submitted, the surety company will perform a credit check. Your credit score plays a big role in determining your bond premium. A higher credit score usually means a lower premium. Don’t worry if your credit isn’t perfect; many companies offer bonds to those with less-than-stellar credit, though the cost might be higher.

Tip: If you have bad credit, consider working with a surety that specializes in “credit-challenged” applicants. They can help you secure a bond, although you may pay a higher premium.

Online Purchase

The good news is that you can often complete the entire process online. Many companies offer instant quotes and allow you to purchase your bond directly through their website. This convenience speeds up the process, often allowing you to get your bond the same day you apply.

Quick Fact: Some states, like Texas, even allow you to download your bond instantly after purchase, which saves time and hassle.

Once your bond is approved and paid for, you’ll receive a copy to submit with your licensing application. Keeping your bond active is essential for maintaining your public adjuster license, so mark your calendar for renewal dates!

With your bond in hand, you’re one step closer to becoming a licensed public adjuster. Next, we’ll tackle some common questions about public adjuster bonds.

Frequently Asked Questions about Public Adjuster Bonds

What is an adjuster bond?

An adjuster bond, specifically a public adjuster bond, acts as a financial guarantee. It’s a promise to the state and your clients that you will follow the rules and act ethically. This bond protects consumers by ensuring that public adjusters adhere to state regulations and business practices. If you break these rules, a claim can be made against your bond. The surety company will pay out on valid claims, but you must repay them, which can be costly.

Are public adjusters worth the money?

Public adjusters can indeed be worth the investment. When you file an insurance claim, the process can be complex and overwhelming. Public adjusters work for you, not the insurance company, to ensure you get a fair settlement. They have specialized expertise in handling claims and can often negotiate better payouts. This can give you peace of mind, knowing you have someone on your side who understands the intricacies of insurance claims.

What are the disadvantages of a surety bond?

While surety bonds offer essential protection, they come with some drawbacks. Cost is a primary concern; premiums can range from 1% to 7.5% of the bond amount, depending on factors like your credit score. Even if you have excellent credit, the cost might still be significant. Additionally, bonds provide limited coverage. They don’t protect you from all risks, only those specified in the bond agreement. If a claim is made, you’ll be responsible for reimbursing the surety, which can add financial strain.

These bonds are crucial for maintaining your license and ensuring trust with clients. However, understand both their benefits and limitations. Up next, we’ll explore more about how these bonds fit into the broader landscape of public adjusting.

Conclusion

As we wrap up our guide on bonding for public adjusters, it’s crucial to highlight the role of Insurance Claim Recovery Support in helping policyholders steer the often complex world of insurance claims. Our firm is dedicated to advocating for policyholders, ensuring they receive the maximum settlement they deserve. We specialize in handling property damage claims, including those from fire, hail, hurricanes, and more, particularly in areas like Austin, Dallas, Fort Worth, and beyond.

Public adjusters are vital allies in the insurance claim process. They work exclusively for the insured, not the insurance company, providing the expertise needed to secure fair compensation. This means policyholders can focus on recovery while we deal with the intricacies of claims.

In Texas and across the nation, our goal is to stand by policyholders, offering peace of mind and expert guidance. We believe everyone deserves a fair settlement, and we are committed to making that happen.

For more information on how we can assist with your insurance claims, visit our service page. We are here to support you every step of the way.