Why Your Apartment Building Needs Specialized Insurance

Apartment complex insurance is a commercial policy designed to protect multifamily property owners from the unique risks of operating residential buildings. Unlike standard homeowners policies, it provides comprehensive coverage for property damage, liability claims, and loss of rental income.

Quick Answer: Essential Apartment Complex Insurance Coverages

- Commercial Property Insurance – Covers the building and assets from perils like fire, wind, and vandalism.

- General Liability Insurance – Protects against tenant injuries, slip-and-fall claims, and discrimination lawsuits.

- Business Income Insurance – Replaces lost rental income during repairs after a covered loss.

- Ordinance and Law Coverage – Covers increased costs to rebuild to current building codes.

- Umbrella Insurance – Provides additional liability coverage beyond primary policy limits.

- Flood Insurance – Required separate coverage for properties in flood-prone areas.

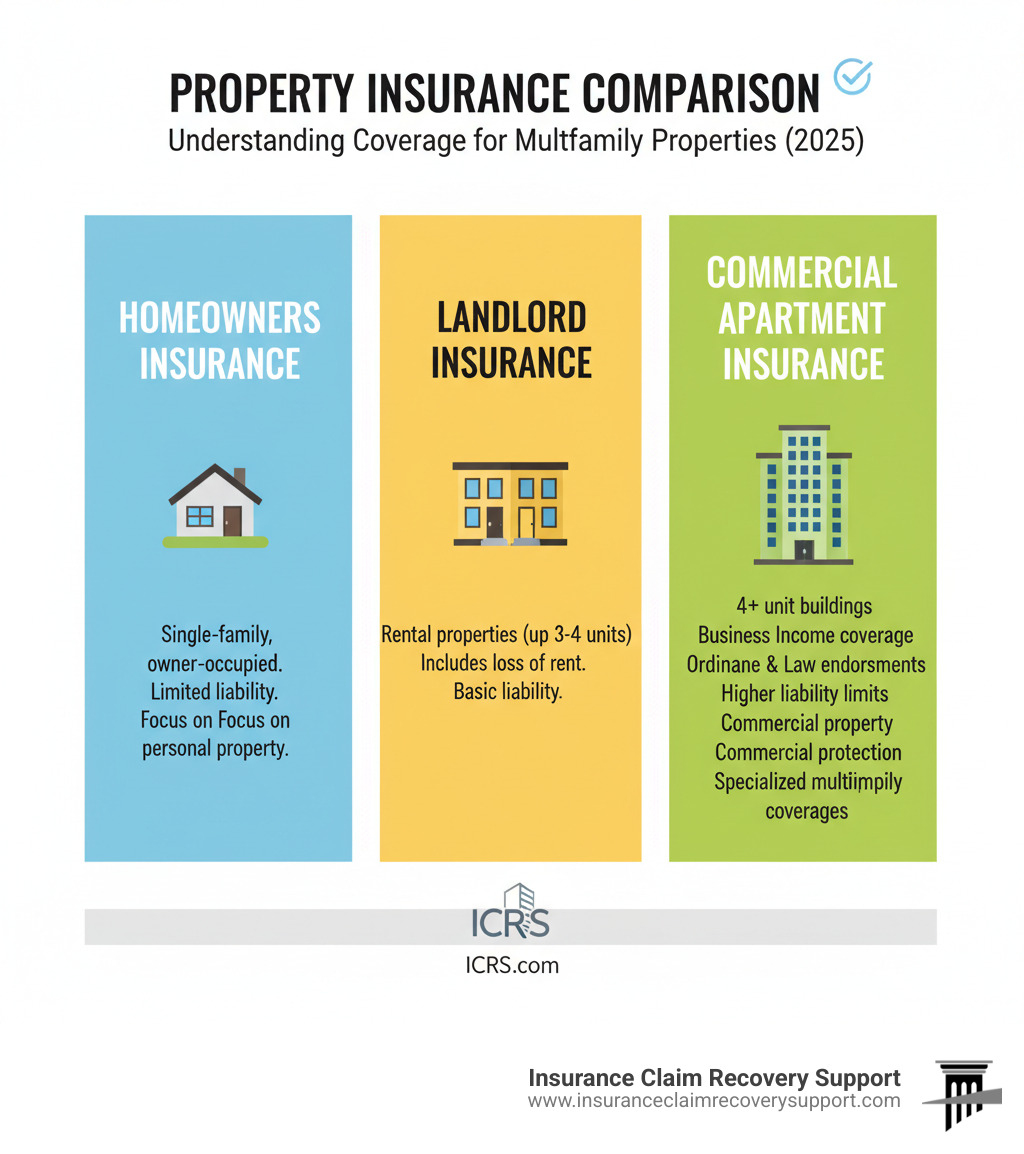

As a multifamily property owner, you face different risks than a single-family homeowner. The dense living arrangements, shared spaces, and high tenant turnover create heightened liability exposures that a standard landlord or homeowners policy cannot address. A standard homeowners policy doesn’t cover properties with four or more units, and even landlord policies often fall short of the protection offered by true commercial property insurance. The gap between what you think is covered and what your policy actually pays can be financially devastating.

Consider the reality: slip-and-fall incidents are frequent and can lead to costly lawsuits. A fire can require demolition and rebuilding to meet updated codes. Without the right coverage, these events can threaten your entire investment.

Myth: My current insurance policy will cover everything I need.

�� Fact: Many policies exclude critical perils like flooding and earthquakes and lack adequate Ordinance and Law coverage to bring older buildings up to current codes after a loss.

Myth: I can handle the claims process on my own.

�� Fact: Insurance companies bring teams of experts to protect their financial exposure. Without your own expert representation, you risk significant underpayment or denial.

I’m Scott Friedson, CEO of Insurance Claim Recovery Support. As a Public Adjuster with over 15 years of experience, I specialize in helping multifamily property owners steer complex claims and maximize their recoveries, often by 30% to more than 3,800%, while avoiding unnecessary litigation.

More info about Commercial Property Damage

Deconstructing Your Policy: Essential Coverages for Apartment Complex Insurance

Your insurance policy needs specific coverages to protect your investment. Let’s break down the core components of a robust protection plan for your multifamily property.

Protecting Your Physical Property and Assets

Protecting your building’s physical structure is paramount. This is where Commercial Property Insurance steps in as the main shield for your investment.

Commercial Property Insurance covers damage to your building and its fixtures from perils like fire, windstorms, vandalism, and explosions. This coverage can also extend to furniture and fixtures in common areas like lobbies and fitness centers. However, standard policies have typical exclusions. Damage from flooding and earthquakes is almost always excluded and requires separate policies or endorsements. It’s a common mistake for owners to assume they’re fully covered, only to find a specific peril was left out after a disaster.

This brings us to a vital coverage for older properties: Ordinance and Law coverage. If your building suffers significant damage, local building codes may have changed since it was constructed. This coverage helps pay the increased costs to demolish undamaged parts of the building and rebuild to meet today’s code requirements. Without it, you could face a massive bill just to bring your property up to code.

For properties in flood-prone areas, Separate Flood Insurance is often a must-have. Lenders typically require it for properties in FEMA-designated flood plains. Even if you’re not in a high-risk zone, consider that nearly 20% of all National Flood Insurance Program (NFIP) claims occur in areas with low to moderate flood risk. A sudden downpour in Austin or a storm surge in Galveston could cause devastating flood damage that your standard policy won’t cover.

Shielding Your Business from Liability and Lawsuits

Owning an apartment complex means constant interaction with tenants and visitors, each presenting potential liability risks. Protecting your business from lawsuits is as critical as protecting your physical property.

General Liability Insurance is your first line of defense against third-party claims for bodily injury or property damage on your premises. This is essential for any apartment owner. It covers common incidents like a tenant slipping on a wet floor or ice in the parking lot, which can result in costly lawsuits. This coverage can also protect you from claims of discrimination.

While general liability protects you, Tenant Legal Liability Insurance protects the renter. This is typically part of a renter’s insurance policy and covers the tenant if they accidentally damage your property. Your policy does not cover tenants’ personal belongings. We strongly recommend requiring tenants to carry their own renter’s insurance to protect their possessions and provide liability coverage for their actions.

For an added layer of financial protection, Umbrella Insurance is invaluable. This policy activates when the limits of your primary liability coverages are exhausted. If you face a catastrophic claim, such as a multi-million dollar lawsuit, your umbrella policy provides additional coverage, acting as a crucial safety net to protect your investment.

Finally, if you work with property managers or contractors, ensure they are licensed, bonded, and carry their own sufficient insurance. Your contracts should stipulate that they name your property as an additional insured on a primary non-contributory basis. This ensures their insurance responds first if they cause an incident, protecting your policy and claims history.

More info about Commercial Buildings Claims

Securing Your Revenue Stream with the Right Apartment Complex Insurance

An apartment complex is a business designed to generate rental income. When disaster strikes, you need specialized coverages to protect your revenue stream.

Business Income Insurance, or Business Interruption Coverage, is critical. If a covered peril makes your units uninhabitable, this coverage replaces that lost rental income. It can also cover ongoing expenses like your mortgage payments, utilities, property taxes, and payroll. Understanding the nuances of this coverage is vital for maximizing your recovery.

While Business Income Insurance covers loss from physical damage, Rent Default Insurance addresses tenants not paying rent. This coverage protects you when tenants stop making payments, providing income until the tenant is evicted and a new one is secured.

For many smaller to medium-sized operations, a Business Owners Policy (BOP) can be an excellent all-in-one solution. A BOP bundles general liability and commercial property insurance, which can be more cost-effective. However, BOPs typically do not cover specialized needs like workers’ compensation or professional liability, which require separate policies.

Lastly, always adhere to lender insurance requirements. If your property is financed, your lender will have specific mandates for the types and limits of insurance you must carry. Failing to comply can put you in breach of your loan agreement.

More info about Business Interruption Loss

From Prevention to Payout: A Strategic Guide for Property Owners

Protecting your apartment complex requires constant care and foresight. This section is about empowering you to proactively protect your investment and skillfully steer challenges when they arise.

Proactive Risk Management: Lowering Costs and Preventing Claims

The best claim is the one that never happens. Smart risk management can significantly reduce your apartment complex insurance costs and safeguard your property.

Factors influencing your insurance cost include your property’s location, age, construction materials, and the condition of its roof, plumbing, and electrical systems. Insurers also consider your maintenance record and total insurable value.

Here are some practical risk reduction steps:

- Regular Maintenance: Establish a schedule for common areas, roofs, and HVAC systems to catch small issues before they become big problems.

- Safety Equipment: Routinely inspect smoke detectors and fire extinguishers. Consider fire prevention products for kitchens.

- Tenant Screening: A robust screening process can reduce risks related to property damage and non-payment.

- Legal Compliance: Stay current with landlord-tenant laws to avoid costly lawsuits.

- Contractor Oversight: Insist that contractors are licensed, bonded, and insured, and require them to name you as an additional insured.

Maintaining accurate building valuations is also vital. Construction costs and inflation can leave you underinsured. Regularly assess your property’s true replacement cost to ensure your policy limits are sufficient for a total loss.

How to Maximize Your Commercial Property Damage Claim

Navigating the Claims Process for Your Apartment Complex Insurance

When disaster strikes, knowing how to handle the insurance claims process is crucial for a successful recovery. Common risks include tenant injuries, theft, vandalism, and natural disasters like fires, windstorms, and freezes.

When a loss occurs, take these immediate steps:

- Document Everything: Take extensive photos and videos of the damage before any cleanup.

- Mitigate Further Damage: Tarp a damaged roof or shut off a broken water main. Keep all receipts for mitigation efforts.

- Report Promptly: Notify your insurance company as soon as it’s safe.

- Document Costs: Keep meticulous records of all expenses, including temporary housing for tenants and business interruption costs.

- Prepare a Proof of Loss: This formal document details the full extent of your claim.

Understanding the role of an insurance agent vs. a public adjuster is a game-changer. Your agent sells you the policy, but a public adjuster, like our team at Insurance Claim Recovery Support, works exclusively for you to maximize your settlement. Your policy also outlines your duties after a loss; failing to meet them can lead to claim delays or denial. Be aware of underpayment tactics used by carriers, who have teams of experts working to minimize payouts. Without your own expert, you are at a significant disadvantage.

8 Sneaky Tricks Insurance Companies Use to Underpay and Delay Your Claim

Fact vs. Myth: Apartment Complex Insurance Claims

Knowing the facts can save you time, money, and frustration.

-

Myth: My homeowners policy covers my apartment building.

- Fact: A homeowners policy is for single-family homes. Properties with four or more units require a commercial property insurance policy to be properly covered.

-

Myth: The insurance company will always pay what I’m owed.

- Fact: Insurers aim to minimize payouts. Claims are often underpaid or delayed without expert representation on your side. You are at a disadvantage without your own expert.

-

Myth: Lawsuits are the only way to resolve a denied or underpaid claim.

- Fact: Litigation is a long, expensive, and stressful process. A public adjuster can often resolve claims much faster and help you avoid unnecessary lawsuits. Our firm has a 90% settlement success rate without litigation, proving that expert advocacy leads to fair settlements efficiently.

Conclusion: Securing Your Investment’s Future

Your apartment complex is a cornerstone of your financial future. Protecting it demands a comprehensive apartment complex insurance strategy. We’ve explored the essential coverages, from Commercial Property and Ordinance and Law to General Liability, Umbrella, and Business Interruption policies.

The path from prevention to payout is complex, but you don’t have to walk it alone. When disaster strikes, the importance of expert guidance cannot be overstated. The insurance company has a team working for their interests; you deserve the same on your side. A public adjuster levels the playing field, documenting your damages, interpreting complex policy language, and negotiating to ensure you receive the full and fair settlement you are owed.

At Insurance Claim Recovery Support, we specialize in maximizing settlements, reducing delays, and resolving claims with a 90% success rate without resorting to lengthy lawsuits. We advocate for property managers and apartment investors across Texas—including Austin, Dallas, Fort Worth, San Antonio, and Houston—and many other states. Whether your property faces damage from fire, storms, or water loss, we’re here to help you steer your claim and secure your investment’s future.

Get a Free Property Damage Insurance Claim Evaluation by a Public Adjuster