Starting Your Texas Public Adjuster Career: Understanding the Pre-Licensing Requirements

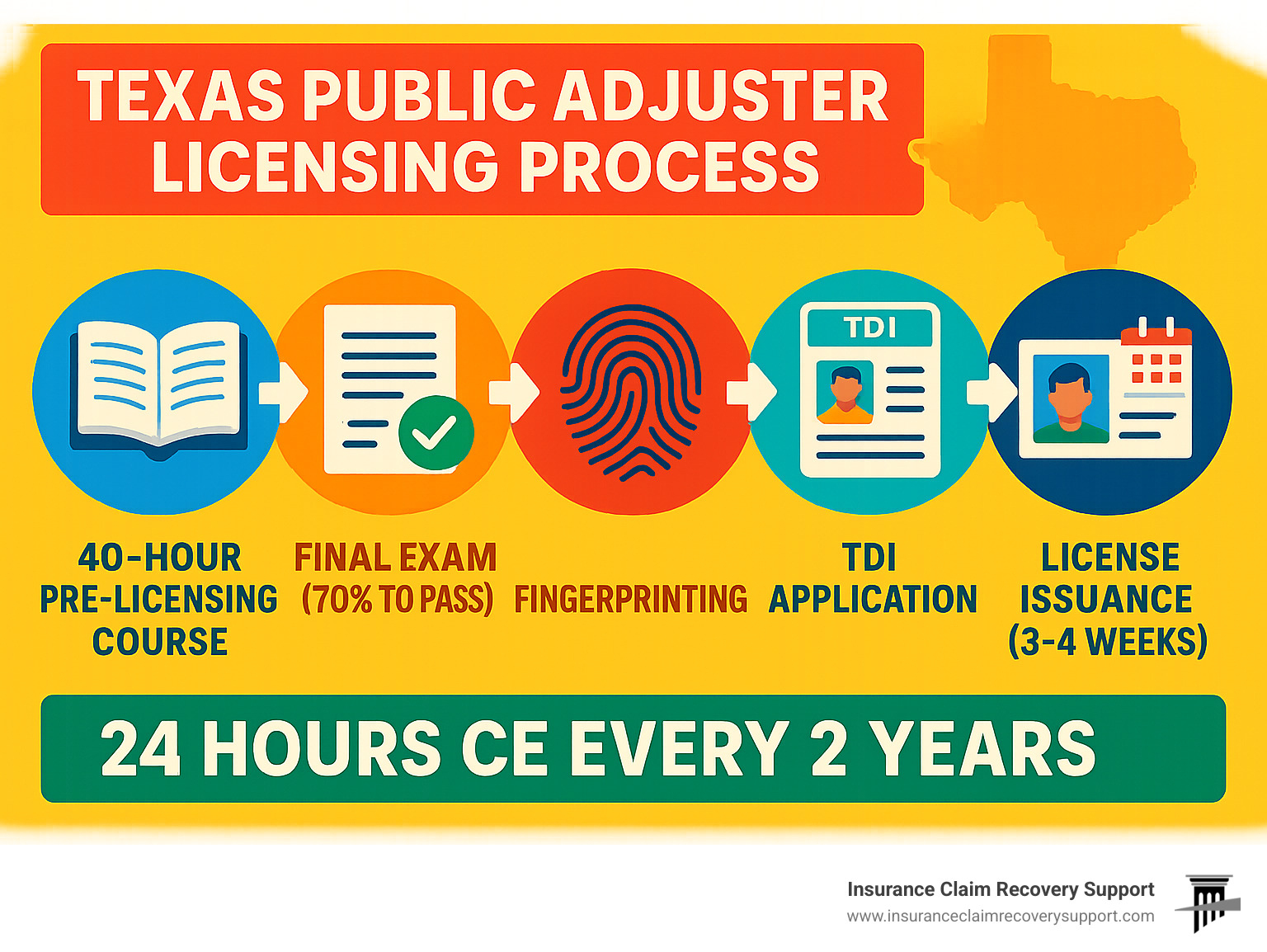

If you’re looking to become a licensed public adjuster in Texas, you’ll need to complete a 40 hour pre licensing course for public adjuster in texas before you can apply for your license. Here’s what you need to know:

- Requirement: 40-hour course approved by the Texas Department of Insurance (TDI)

- Format Options: Online self-paced, live webinar, or in-person classroom

- Cost Range: $279-$354 depending on provider and format

- Exam: 150 multiple-choice questions with 70% passing score

- Next Steps: Submit fingerprints, application via Sircon, and $50 license fee

The 40 hour pre licensing course for public adjuster in texas is your first crucial step toward becoming a qualified professional who can legally represent policyholders in insurance claims. This state-mandated education ensures you understand insurance terms, policy types, claim practices, and Texas-specific regulations before entering the field.

When selecting a course, you’ll want to consider TDI-approved providers that offer comprehensive curriculum covering both the academic knowledge needed to pass the exam and practical insights that prepare you for real-world adjusting scenarios. The good news is that once you complete this course and pass the exam, no additional testing is required to apply for your Texas adjuster license.

I’m Scott Friedson, a multi-state licensed public adjuster and CEO of Insurance Claim Recovery Support LLC who has helped countless professionals steer the 40 hour pre licensing course for public adjuster in texas on their path to successful careers representing policyholders in complex insurance claims.

Why a 40-Hour Pre-Licensing Course Is Mandatory for Texas Public Adjusters

When disaster strikes and you’re facing property damage from a storm, fire, or flood, the last thing you need is an under-qualified adjuster representing your interests. That’s exactly why Texas takes public adjuster education so seriously.

The Texas Department of Insurance (TDI) didn’t just pull the 40 hour pre licensing course for public adjuster in texas requirement out of thin air. This mandatory training exists because public adjusters hold positions of tremendous trust. When homeowners and business owners are experiencing one of life’s most stressful events—major property damage—they need a knowledgeable advocate in their corner.

The science actually backs up TDI’s approach. According to research on adult learning retention, adults typically need between 30-50 hours of structured education to develop competency in technical fields with specialized terminology. The 40-hour requirement sits right in that sweet spot—enough time to build real expertise without creating unnecessary barriers to entering the profession.

Here’s something important to note: while the course is 40 hours total, TDI limits self-study to a maximum of 10 hours. This means at least 30 hours must take place in a structured learning environment (whether virtual or in-person). This rule ensures you’re not just clicking through screens but actually engaging with the material that will make you an effective advocate for policyholders.

Who Must Take the 40 hour pre licensing course for public adjuster in texas?

If you fall into any of these categories, this course has your name on it:

Texas residents looking to become licensed public adjusters must complete the full 40-hour course. There’s no way around it—even if you’ve been in the insurance industry for decades in another role.

Non-resident applicants who don’t already hold a public adjuster license in their home state will also need to complete this training. Texas doesn’t want to create different standards for out-of-state professionals.

Professionals changing license types from company adjuster to public adjuster must take the course too. Why? Because representing policyholders requires a fundamentally different approach and ethical framework than working for carriers.

The basic eligibility requirements are straightforward: you must be at least 18 years old, have valid identification, be willing to undergo fingerprinting for a background check, and demonstrate good character. Anyone with felony convictions related to financial crimes or breach of trust will face significant problems in the licensing process.

TDI Content & Exam Requirements

After completing your 40 hour pre licensing course for public adjuster in texas, you’ll face a comprehensive examination that truly tests your readiness to represent policyholders. The exam consists of 150 multiple-choice questions, and you’ll need to score at least 70% to pass.

What makes this exam particularly challenging is that at least 70% of the questions operate at the “application level” or higher. This means you won’t succeed by simply memorizing definitions. Instead, you’ll need to demonstrate you can apply insurance concepts to real-world scenarios—analyzing policy language, determining coverage, and recommending appropriate actions based on Texas regulations.

Whether you take your exam remotely or in-person, expect serious proctoring measures. Remote proctoring includes sophisticated monitoring software that verifies your identity, watches your environment via webcam, prevents access to unauthorized resources, and flags suspicious behaviors. In-person proctoring follows similarly strict protocols.

These security measures might seem intense, but they serve an important purpose: ensuring that everyone who earns a Texas public adjuster license has legitimately demonstrated the knowledge required to protect consumers during their most vulnerable moments.

By investing in this comprehensive education now, you’re building the foundation for a career where you’ll help Texans steer the often-complex world of insurance claims—a service that’s particularly valuable in a state known for its severe weather events.

Inside the 40 hour pre licensing course for public adjuster in texas

When you enroll in a 40 hour pre licensing course for public adjuster in texas, you’re stepping into a comprehensive educational journey designed to prepare you for success. Think of it as your professional foundation—covering everything from basic insurance principles to the nuanced art of advocating for policyholders.

The curriculum isn’t just designed to help you pass an exam; it’s crafted to prepare you for real-world situations you’ll face when helping Texans recover from property losses. While each provider puts their own spin on presentation, the core content remains consistent across all TDI-approved courses.

Here’s how public adjusting compares to other adjusting paths in Texas:

| Feature | All-Lines Adjuster | Property & Casualty Adjuster | Public Adjuster |

|---|---|---|---|

| Who they represent | Insurance carriers | Insurance carriers | Policyholders |

| Claim types | All insurance lines | Property & casualty only | Property & casualty only |

| Pre-licensing | 40 hours | 40 hours | 40 hours |

| Exam questions | 150 | 150 | 150 |

| Workers’ comp authority | Yes | No | No |

| Reciprocity with other states | Maximum | Limited | Limited |

| Primary focus | Carrier interests | Carrier interests | Policyholder advocacy |

The key difference? Public adjusters stand in the policyholder’s corner, making this role uniquely rewarding for those who want to help people through difficult times.

What Does the 40 hour pre licensing course for public adjuster in texas Cover?

Your 40 hour pre licensing course for public adjuster in texas dives deep into insurance with a practical focus. You’ll become fluent in insurance terminology and concepts, learning to speak the language that will help you advocate effectively for your future clients.

The curriculum thoroughly explores personal lines coverage, with special attention to Texas homeowner policy forms A, B, and C. You’ll learn the critical differences between these forms and how they affect claim settlements—knowledge that directly translates to helping homeowners get fair treatment.

Commercial coverage isn’t overlooked either. The course examines standard fire policies, inland and ocean marine coverage, and the complex world of business interruption claims. These sections prepare you to handle everything from small retail shops to large commercial property losses.

Property valuation becomes second nature as you learn the difference between replacement cost and actual cash value—concepts that can mean thousands of dollars in a settlement. You’ll practice depreciation calculations and understand co-insurance provisions that often trip up inexperienced adjusters.

Ethics and professional conduct receive significant attention, as they should. You’ll explore your fiduciary responsibilities, learn to recognize and avoid conflicts of interest, and understand the advertising restrictions that protect consumers from misleading claims.

The curriculum also covers practical claim handling—from initial inspections to documentation standards and negotiation techniques. These aren’t just theoretical concepts; they’re skills you’ll use daily when representing policyholders after storms, fires, and other disasters across Texas cities like Austin, Dallas, and Houston.

Course Formats & Learning Styles

We all learn differently, which is why the 40 hour pre licensing course for public adjuster in texas comes in various formats to match your personal learning style and schedule.

If you’re self-motivated and need flexibility, online self-paced learning might be your best fit. You can log in at midnight or 5 AM—whenever works for you. Just be aware of the 10-hour cap on self-study; the remaining 30 hours must be completed in a more structured environment. The online modules include built-in timers to ensure you spend the required time with the material. Try to skip ahead, and you’ll find yourself starting that section over!

For those who thrive on interaction but need scheduling flexibility, live webinars offer the perfect middle ground. You’ll learn from experienced adjusters in real-time, ask questions as they arise, and connect with fellow students—all from the comfort of your home office. These sessions typically run over 3-5 days and count as classroom hours, not self-study.

If you’re an in-person learner who absorbs information best through face-to-face instruction, traditional classroom courses remain available in major Texas cities. These intensive programs typically run for 3-5 consecutive days and offer the added benefit of networking with both instructors and classmates—connections that might lead to job opportunities down the road.

Many successful adjusters find that mixing formats works beautifully—perhaps attending live sessions for complex topics while using self-study for review and reinforcement.

Final Exam & Certificate of Completion

The culmination of your 40 hour pre licensing course for public adjuster in texas is a comprehensive final examination that mirrors the challenges of the profession itself. This isn’t just another test—it’s your gateway to applying for licensure without additional state exams.

The exam consists of 150 multiple-choice questions with a 3-hour time limit. You’ll need to score at least 70% (105 correct answers) to pass, with questions spanning everything from policy interpretation to ethical practices and Texas-specific regulations.

What makes this exam particularly challenging is its focus on application. You won’t just recall facts; you’ll analyze claim scenarios, determine coverage under various policy forms, and recommend appropriate actions based on Texas insurance law.

Most providers understand that test anxiety happens to the best of us, allowing up to three attempts to pass without retaking the entire course. If your first attempt falls short, use it as a learning opportunity to identify and strengthen weak areas before trying again.

Once you’ve conquered the exam, you’ll receive your Certificate of Completion—typically within a few days for online providers, though TDI allows up to 30 days. This certificate becomes your golden ticket when applying for your license through the TDI portal.

Providers maintain records of your course completion and exam results for at least four years, but do yourself a favor and keep your own copy in a safe place. You never know when you might need to reference it, especially if you later pursue licensing in other states.

For more insights into what life looks like after you become a licensed adjuster, visit our Licensed Adjuster information page.

From Classroom to License: Step-by-Step Path After the 40-Hour Course

Congratulations on completing your 40 hour pre licensing course for public adjuster in texas! Now comes the exciting part—turning that hard-earned knowledge into an official license. Let’s walk through what happens next on your journey to becoming a Texas public adjuster.

The path from classroom to license is straightforward but requires attention to detail. First, you’ll need your certificate of completion—this golden ticket proves you’ve met the educational requirements. Double-check that all information is correct, and keep both digital and physical copies handy. You’ll need to upload this during your application.

Next comes fingerprinting through IdentoGO—an important security step the TDI requires. Schedule your appointment online, bring your government ID, and be prepared to pay around $70 for the service. It’s quick and painless, usually taking less than 15 minutes.

With your certificate and fingerprints ready, it’s time to tackle the Sircon portal—the online gateway to your license application. You’ll create an account, fill out your information, upload your certificate, and pay the $50 application fee. Think of Sircon as your digital liaison with the Texas Department of Insurance.

Behind the scenes, the TDI will conduct a thorough background check, reviewing your criminal history, financial responsibility, and overall character. This is why honesty on your application is absolutely crucial—even minor omissions can derail your licensing process.

The waiting game typically lasts 3-4 weeks, after which your license arrives electronically. The entire journey from course completion to license in hand usually spans 4-6 weeks, assuming all your documentation is in order.

Filing Your Texas Public Adjuster Application

The Sircon application might seem intimidating, but breaking it down into manageable pieces makes it much less daunting. The most important rule? Accuracy matters. Every piece of information you provide must match your government ID exactly—discrepancies can cause delays or even rejection.

Full disclosure is non-negotiable when it comes to your history. The application will ask about criminal history, professional discipline, and financial issues including bankruptcies. Here’s the thing—many past issues won’t automatically disqualify you, but failing to disclose them almost certainly will. Honesty truly is the best policy here.

One unique requirement for Texas public adjusters is the $10,000 surety bond. This financial safety net protects your future clients and demonstrates your professional commitment. You’ll need to secure this bond and provide proof during your application process. For a deeper dive into this requirement, check out our Bonding for Public Adjusters page.

If you’re applying as a non-resident adjuster, the process has some additional nuances. You’ll need to provide information about your home state license if you have one. Similarly, if you’re planning to operate as a business rather than an individual, additional registration steps will apply.

Maintaining & Expanding Your Credentials

Getting your license isn’t the finish line—it’s actually just the starting point of your professional journey. To keep your credentials active and grow your expertise, ongoing education is essential.

Texas requires 24 hours of continuing education every two years, including ethics training. All courses must have TDI approval, and you should maintain records of completion. Think of these requirements not as bureaucratic hoops but as opportunities to sharpen your skills in an ever-changing industry.

Beyond the basics, the most successful public adjusters invest in supplemental skills training. Becoming proficient with Xactimate estimating software can dramatically improve your effectiveness. Likewise, advanced training in property inspection techniques, negotiation strategies, and building codes will set you apart in a competitive field.

Your Texas license also opens doors to other states through reciprocity options. Many states will recognize your Texas credentials, potentially waiving additional pre-licensing requirements. The Designated Home State (DHS) option is particularly valuable for non-residents. Always verify current requirements with any state where you plan to practice, as regulations can change.

In my years at Insurance Claim Recovery Support, I’ve noticed that the adjusters who thrive see education as an ongoing journey rather than a checkbox exercise. The insurance landscape is constantly evolving—especially in Texas, where weather events regularly reshape property insurance practices. Staying current isn’t just good for compliance; it’s essential for effectively representing your clients when they need you most.

Costs, Providers, and Choosing the Right Training Format

When you’re mapping out your journey to becoming a Texas public adjuster, understanding the investment required helps you plan accordingly. Let’s talk about what you can expect to pay and how to choose the right training option for your learning style and budget.

The 40 hour pre licensing course for public adjuster in texas varies in price depending on the format you choose. Online self-paced courses typically run between $279-$299, giving you the most budget-friendly option. If you prefer live instruction, webinar formats cost slightly more at $299-$349, while in-person classroom experiences range from $349-$354.

Many aspiring adjusters find value in bundled packages that include the pre-licensing course plus Xactimate training (the industry-standard estimating software). These packages run $645-$699 but can save you money compared to purchasing courses separately while giving you a valuable competitive edge in the job market.

Remember to factor in the additional expenses beyond just the course itself. You’ll need about $70 for fingerprinting, $50 for your license application fee, and between $100-$500 annually for your required $10,000 surety bond. All told, your initial investment to get licensed typically falls between $500-$900.

“I recommend students look beyond just the price tag when selecting a course,” says Scott Friedson, CEO of Insurance Claim Recovery Support. “The quality of your education directly impacts your ability to effectively represent policyholders when they need you most.”

How to Evaluate TDI-Approved Providers

Not all Texas Department of Insurance-approved course providers deliver the same quality education. Here’s what to look for when choosing where to invest your time and money:

Curriculum relevance should be your first consideration. The best courses go beyond generic insurance concepts to include Texas-specific examples and scenarios you’ll actually encounter in the field. Look for materials that cover recent legislative changes and include plenty of practice with the types of claims common in Texas – from hailstorms in Dallas to hurricane damage along the coast.

Instructor credentials matter tremendously. Providers with instructors who have actual public adjusting experience in Texas bring invaluable real-world insights to their teaching. Don’t hesitate to ask about their background and experience before enrolling.

Student success metrics tell an important story. Ask providers about their first-time exam pass rates and, if possible, speak with recent graduates about their experience. A reputable provider should be transparent about their success rates and willing to connect you with past students.

Learning support resources can make or break your experience. Some providers offer bare-bones courses with little assistance, while others provide comprehensive support including study guides, practice exams, and responsive instructor access for questions. The difference becomes particularly important if you encounter challenging concepts.

Flexibility options are worth considering, especially if you’re balancing your studies with work or family responsibilities. Can you access the course on mobile devices? Download materials for offline study? Pause and resume lessons as needed? These features can significantly improve your learning experience.

Many providers offer free orientation sessions or sample lessons. Take advantage of these opportunities to test-drive the learning platform and teaching style before committing your money and time.

For those interested in expanding their knowledge beyond the basics of public adjusting to better serve business clients, our Business Public Adjuster page offers valuable insights into commercial claim handling.

Your pre-licensing education is the foundation upon which you’ll build your entire career. While it might be tempting to choose the cheapest option, investing in quality training from the start can pay dividends in your confidence, competence, and ultimate success in this rewarding field.

Beyond the License: Career Outlook & Recommended Skills in Texas

Texas offers an exceptionally promising landscape for public adjusters. With its vast size and diverse climate zones, the Lone Star State experiences virtually every type of property-damaging event imaginable throughout the year. This creates a steady stream of opportunities for professionals who’ve completed their 40 hour pre licensing course for public adjuster in texas.

What makes Texas particularly attractive for public adjusters? Consider the weather patterns alone: North Texas and the Panhandle see devastating hailstorms, while the Gulf Coast battles hurricanes and tropical storms. Central and North Texas residents face tornado threats, and various regions contend with wildfires, flooding, and even severe winter freeze events like the memorable 2021 storm. Each disaster creates a wave of insurance claims—and a need for knowledgeable public adjusters to advocate for policyholders.

This diversity means you can build a thriving career in any major Texas metropolitan area. In Austin, the rapidly growing population and expanding suburbs generate consistent demand. Dallas-Fort Worth sees frequent wind and hail events that create seasonal work spikes. San Antonio property owners often need help with flash flooding and wind claims, while Houston faces hurricane, tropical storm, and flood challenges. Even smaller markets like Lubbock, San Angelo, and Waco offer specialized opportunities due to their unique weather patterns.

As a Texas public adjuster, you’ll likely work either as a field adjuster or desk adjuster. Field adjusters spend their days conducting on-site inspections, meeting face-to-face with clients, documenting damages, and traveling throughout their territory. They need strong people skills and local market knowledge. Desk adjusters focus more on remote claim handling, policy analysis, estimate review, and carrier negotiations. Both paths offer rewarding careers, but require skills beyond what’s covered in your 40 hour pre licensing course for public adjuster in texas.

Continuing Education & Advanced Training Options

Your license is just the starting point. The most successful public adjusters view education as a career-long journey, not a one-time requirement.

Property inspection skills form your technical foundation. Learning to properly assess roof systems, identify water damage patterns, evaluate fire and smoke damage, and understand building code compliance will set you apart. Many adjusters now incorporate drone technology for safer, more thorough inspections of difficult-to-access areas.

Estimating software mastery is non-negotiable in today’s industry. Xactimate certification (available in levels 1-3) is practically essential, while familiarity with Symbility and various digital measurement tools will make you more versatile. Strong photo documentation skills and the ability to work with 3D modeling applications round out your technical toolkit.

Don’t overlook the power of negotiation and communication skills. The ability to interpret insurance policies, document findings effectively, present your case persuasively, handle objections professionally, and employ mediation techniques when needed will dramatically increase your settlement success rate.

Many adjusters eventually need business development skills too. Client relationship management, building referral networks, participating in professional associations, conducting community education, and understanding digital marketing fundamentals become increasingly important as your career advances.

Consider developing expertise in specific claim types or property categories. Specialists in commercial properties, high-value homes, historic structures, or particular damage types like water mitigation can command premium fees and build distinguished reputations.

Job Opportunities After Licensing

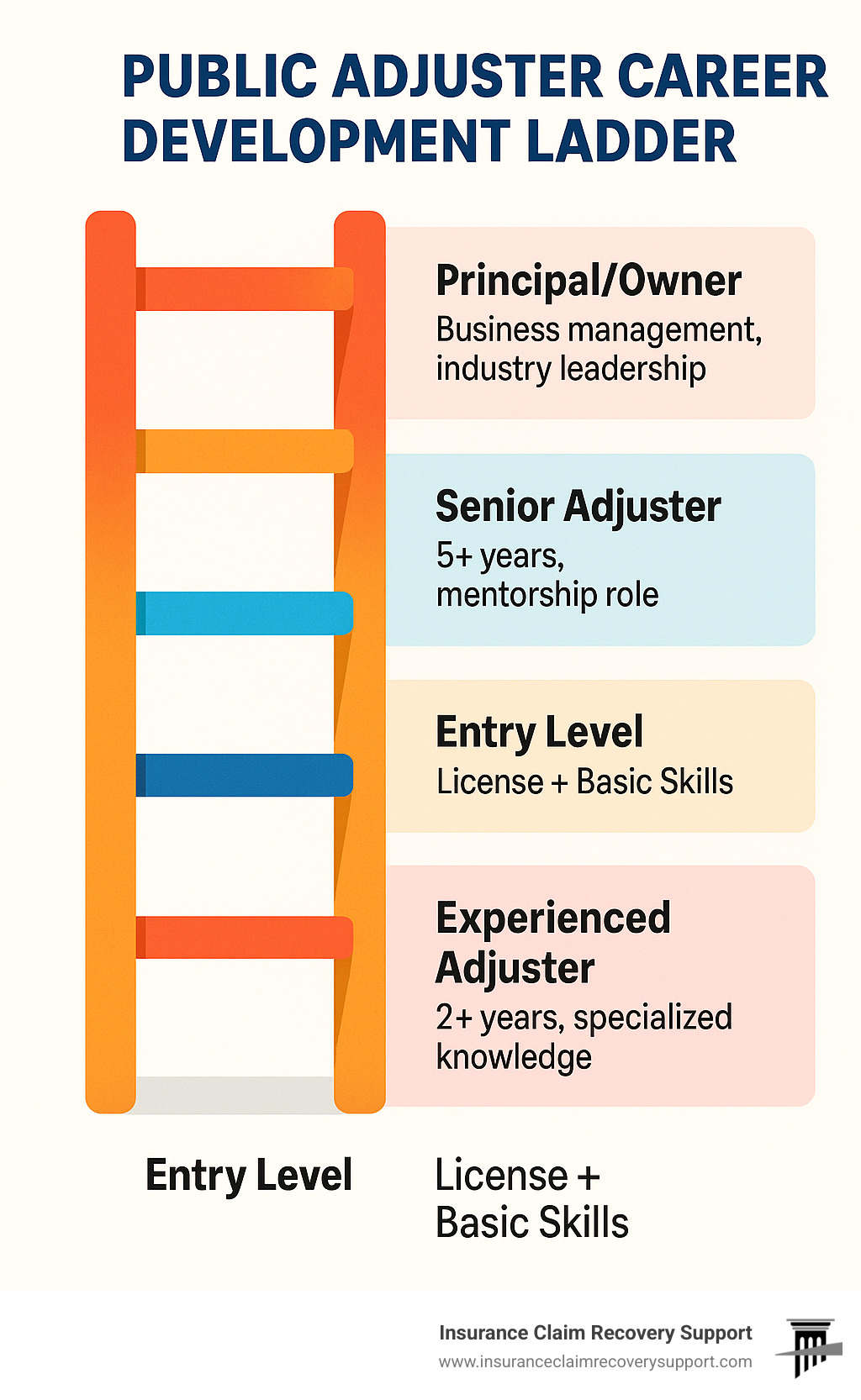

With your Texas public adjuster license in hand, several career paths await you.

Many new adjusters start with established public adjusting firms like Insurance Claim Recovery Support. This path offers invaluable benefits: exposure to diverse claim types, mentorship from experienced professionals, and stable income often supplemented with performance bonuses. It’s the ideal environment to build your skills while earning.

Some adjusters eventually launch their own practices. This path offers complete autonomy and potentially higher earnings, but comes with significant challenges: business development responsibilities, operational demands, and necessary investments in marketing and infrastructure. It’s typically best attempted after gaining experience with an established firm.

For those who thrive in high-intensity environments, catastrophe response teams offer a unique opportunity. These roles involve deployment to disaster areas, intensive work periods, and travel requirements, but can generate substantial short-term earnings. Many adjusters find the seasonal nature of this work appealing, especially when paired with other professional activities.

The earning potential for Texas public adjusters is impressive. Entry-level positions typically start at $40,000-$60,000, while experienced adjusters (3-5 years) often earn $60,000-$100,000. Senior adjusters with specialized expertise regularly command $100,000-$200,000+, and those who build successful firms face virtually unlimited earning potential.

Unlike company adjusters who receive fixed salaries, public adjusters typically earn a percentage of the claims they settle. This creates a direct link between your skill development, work ethic, and financial rewards—one of the many reasons public adjusting attracts ambitious professionals who’ve completed their 40 hour pre licensing course for public adjuster in texas.

Frequently Asked Questions about Texas Public Adjuster Pre-Licensing

How long does it take to finish the course if it’s self-paced?

Most students wonder about the time commitment for completing a 40 hour pre licensing course for public adjuster in texas. While the name suggests exactly 40 hours, your actual completion time will vary based on your background and study habits.

The course has state-mandated timers that prevent rushing through material, ensuring you spend the required time absorbing important concepts. Only 10 hours can be self-study – the remaining 30 hours must be completed in a structured format with verification of your participation.

If you’re working full-time and studying evenings and weekends, you’ll likely finish in 3-4 weeks. Some dedicated students who can focus full-time complete the course in as little as one week. What I’ve noticed with successful students is that consistent engagement works better than cramming. The material builds progressively, and you’ll need time to integrate complex insurance concepts that will serve as the foundation of your career.

Can I retake the final exam without re-enrolling?

Good news! Most TDI-approved providers understand that test anxiety happens and allow multiple attempts at the final exam without making you re-enroll in the entire course. Typically, you’ll get three attempts included with your initial enrollment fee.

If you don’t pass after these attempts (which is rare for well-prepared students), provider policies vary:

Some require complete re-enrollment at full cost, while others offer reduced “exam only” options. A few generous providers even provide free retakes if you can show you’ve done additional studying.

The smartest approach? Thoroughly prepare for your first attempt by taking multiple practice exams until you consistently score 90% or higher. When students struggle with the exam, it’s usually because they rushed through practice tests. Most providers offer detailed feedback on your weak areas if you do need a retake, allowing you to focus your studies before the next attempt.

Is the Texas license reciprocal with Florida, Louisiana, or Oklahoma?

Texas public adjusters often work across state lines, especially during disaster recovery. Here’s how your Texas license translates to neighboring states:

With Oklahoma, you’re in luck – they offer full reciprocity with Texas. No additional pre-licensing education is required, though you’ll still need to submit an application and pay fees. If you’ve recently completed a background check for Texas, Oklahoma may even waive their background check requirement.

Louisiana offers partial reciprocity. While they’ll waive the pre-licensing education requirement, you’ll still need to pass a Louisiana-specific exam and meet their bond requirements. The good news is that many concepts from your Texas training will apply.

Florida has more limited reciprocity. They require completion of a Florida-specific 40-hour course and passing their state exam. Florida also has higher bond requirements than Texas. If you’re planning to work in Florida regularly, budget time and resources for these additional requirements.

For adjusters working multiple states like we do at Insurance Claim Recovery Support, maintaining your Texas license in good standing is essential since it serves as the foundation for reciprocal licensing throughout the region.

Always verify current reciprocity requirements directly with each state’s insurance department before applying, as these agreements can change periodically.

Conclusion

Completing the 40 hour pre licensing course for public adjuster in texas marks the beginning of what can be an incredibly fulfilling career helping people during some of their most difficult moments. This foundational training equips you with critical knowledge about insurance principles, policy language, and Texas-specific regulations that you’ll use every day when representing policyholders.

But let’s be honest—while this course checks the legal box that allows you to enter the profession, it’s just your first step on a much longer journey. The most successful public adjusters I’ve worked with see this 40-hour requirement not as a hurdle to clear, but as the cornerstone of their professional development.

Think of your pre-licensing education as learning the rules of the game. Your real value as a public adjuster develops as you combine this knowledge with hands-on experience, mentorship from seasoned professionals, and continuous learning throughout your career. The insurance landscape is always evolving, especially in a weather-diverse state like Texas, and staying current is essential to providing the best service to your clients.

What makes this career particularly rewarding is the tangible impact you’ll have on people’s lives. When a family in Austin loses their home to fire, or a business owner in Houston faces devastating flood damage, your expertise will help them steer complex claims and receive fair settlements. At Insurance Claim Recovery Support, we’ve built our reputation on being true advocates for policyholders across Texas—from Dallas to San Antonio, Lubbock to Waco, and everywhere in between.

Yes, becoming a Texas public adjuster requires investment—of your time, money, and considerable effort. But for those committed to policyholder advocacy, the rewards make it worthwhile. Beyond the financial benefits (which can be substantial), there’s something deeply satisfying about helping people rebuild after disaster strikes.

With proper training, ongoing education, and an unwavering commitment to ethical practice, you’ll be well-positioned to thrive in this dynamic and essential profession. The path may not always be easy, but few careers offer the same combination of intellectual challenge, financial opportunity, and meaningful impact.

For more information about public adjusting in Texas, visit our Public Insurance Adjuster Texas page.